"After being passed over for a partner at Goldman Sachs twice, Tepper quit in December 1992 and created Appaloosa Management in early 1993. This hedge fund has been raking it in. It has returned roughly 25% a year since its founding. One of his hallmark strategies is to buy up distressed stocks, especially those of companies with debt-laden balance sheets."

"He's now selling many AI holdings and popular stocks, a very contrarian move. Let's take a look. Stock #1: UnitedHealth (UNH) Tepper's largest sale for Q3 2025 was UNH. He shaved off 92% of his position, or about $780 million worth of the stock. UNH turned into a fan-favorite for hedge funds after it halved in value. After all, how can you pass on America's largest insurance business at a 50% discount?"

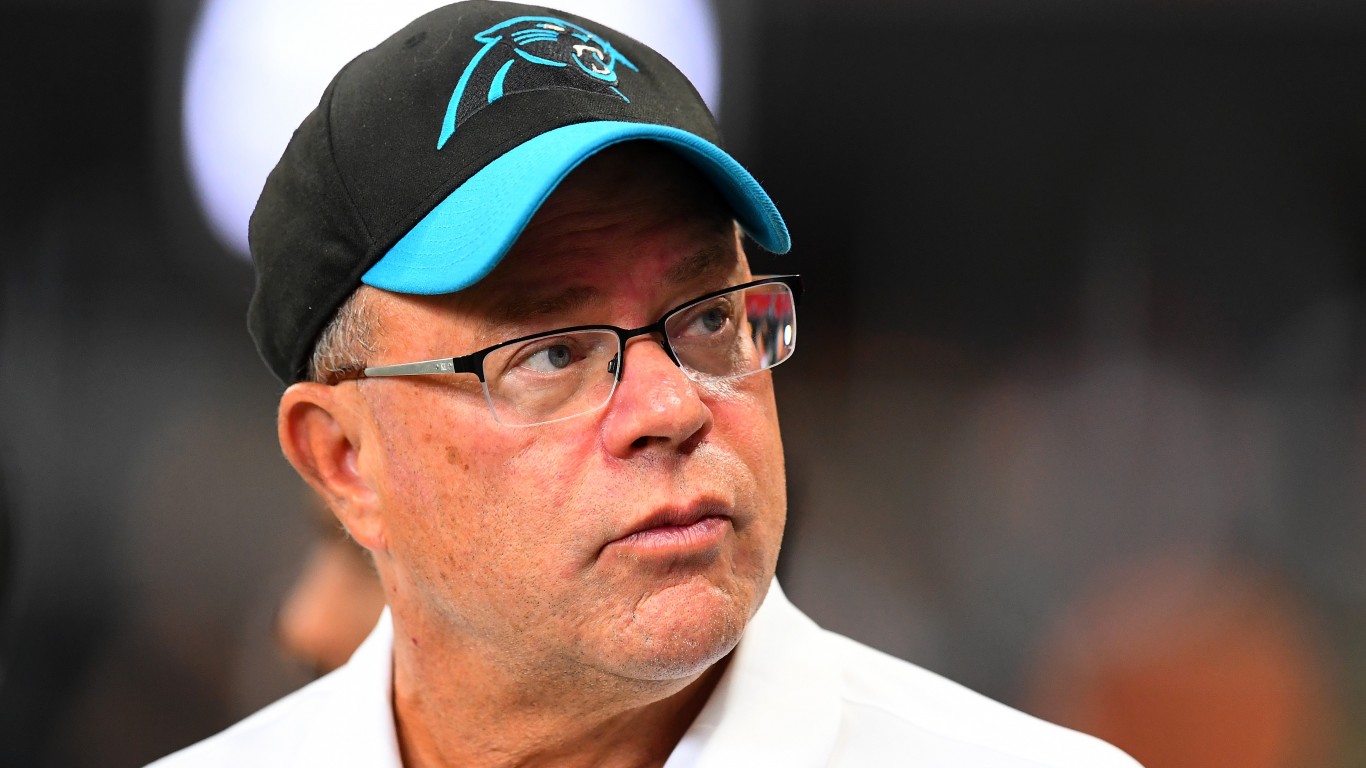

David Tepper founded Appaloosa Management in early 1993 after leaving Goldman Sachs and owns the Carolina Panthers and Charlotte FC. Appaloosa has averaged roughly 25% annual returns since its founding. Tepper's hallmark strategy targets distressed, debt-laden companies and he earned about $7 billion in 2009 by buying distressed financial stocks. Tepper is reducing exposure to many AI-related and popular stocks in a contrarian repositioning. His largest Q3 2025 sale was UnitedHealth, where he cut about 92% of the position, roughly $780 million. He may be trimming losses from peak purchases or taking profits if he bought the dip. Intel has also seen repositioning amid leadership changes.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]