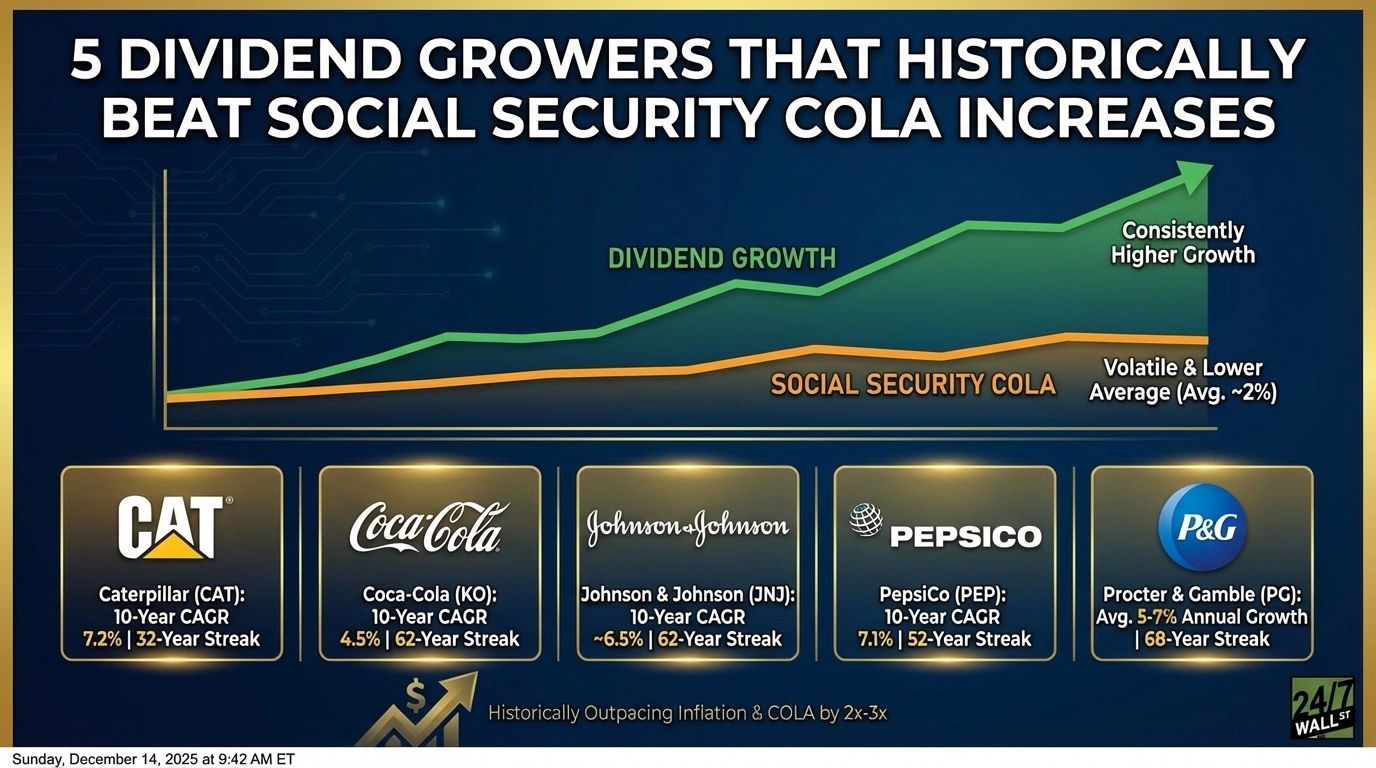

"The Social Security Administration announced in October that beneficiaries will receive a 2.8% cost-of-living adjustment (COLA) in 2026, following a 2.5% increase in 2025. While these adjustments help protect purchasing power for 71 million Americans, dividend growth stocks have historically delivered substantially higher annual increases. Five blue-chip companies with multi-decade dividend growth streaks have consistently outpaced Social Security's typical 2-3% annual adjustments."

"Caterpillar ( NYSE:CAT) has delivered a 10-year compound annual dividend growth rate of 7.2%, more than tripling typical COLA increases. The industrial equipment manufacturer raised its quarterly dividend 7.1% to $1.51 in December 2025, marking its 32nd consecutive year of increases. Caterpillar's annual dividend has surged from $1.84 in 2012 to a projected $6.04 in 2026, a 228% increase over 14 years. The company generated $3.7B in operating cash flow in Q3 2025 and returned $1.1B to shareholders."

Social Security beneficiaries will receive a 2.8% COLA in 2026 after a 2.5% increase in 2025, following volatile recent adjustments including 8.7% in 2023 and 3.2% in 2024. Long-term COLAs have averaged about 2% annually, with some years showing no increase. Dividend-growth blue-chip companies have delivered substantially higher annual dividend increases and have compounded payouts over multi-decade streaks that outpace typical 2–3% COLAs. Caterpillar exemplifies this trend with a 10-year dividend CAGR of 7.2%, a raised quarterly payout to $1.51 in December 2025, strong operating cash flow, and a conservative payout ratio near 30%.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]