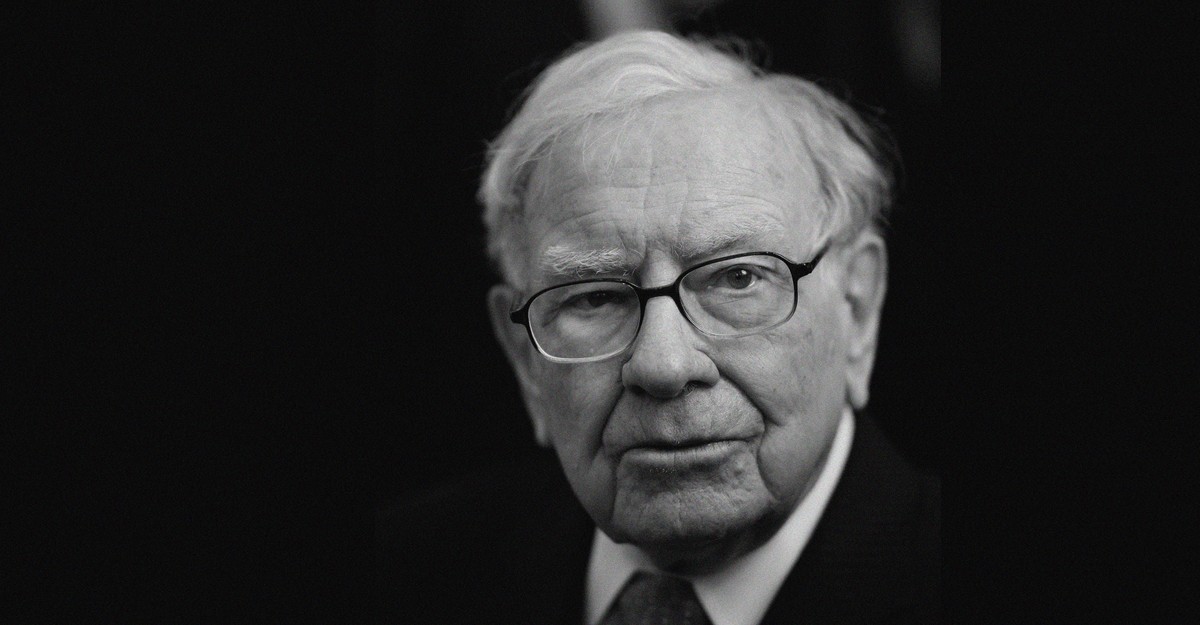

"Warren Buffett has long been known and admired around the world for doing something that is, at its essence, mundane. He is not a brilliant artist or a great inventor or a record-setting athlete. Instead, his brilliance-a low-key, midwestern type of brilliance-found expression in the prosaic art of investing: buying this stock and avoiding that one. Buffett himself has called this task "simple, but not easy.""

"Buffett's imminent retirement at the age of 95 is a moment to reflect on the qualities that have made him the most successful investor of all time. These qualities-relentless curiosity, analytical consistency, focused effort, and humility, along with high integrity, a personality unchanged by wealth or success, and a sunny optimism about the United States-have made him an American role model."

Warren Buffett became the most successful investor by consistently buying the right stocks and avoiding the wrong ones. His approach has been simple in principle but difficult in practice. Relentless curiosity, analytical consistency, focused effort, humility, high integrity, an unchanged personality despite wealth, and optimism about the United States underpinned his success. He exemplified old-fashioned American values such as free markets, democratic governance, patriotism, and common sense. Buffett showed precocious business instincts from childhood, making his first investment at age 11 and earning money selling peanuts, popcorn, delivering newspapers, producing a racetrack tip sheet, and placing pinball machines in barbershops.

Read at The Atlantic

Unable to calculate read time

Collection

[

|

...

]