"The summer season isn't quite over yet, and neither are the gains for the S&P 500, which is just one more good day away from passing the 6,600 level for the very first time. Undoubtedly, this market winning streak has been quite unexpected, especially since September tends to be a wake-up call for investors who haven't yet taken some profits off the table."

"Either way, staying invested for the long term stands out as being wiser than trying to get out with the intent of getting back in after the market rolls over into a valley of sorts. Indeed, I was never the biggest fan of selling in May or September and going away. It may work some years, but it could fall flat in others. It's best to focus on the individual companies themselves, as there can be relative winners, even when markets flatline or head south."

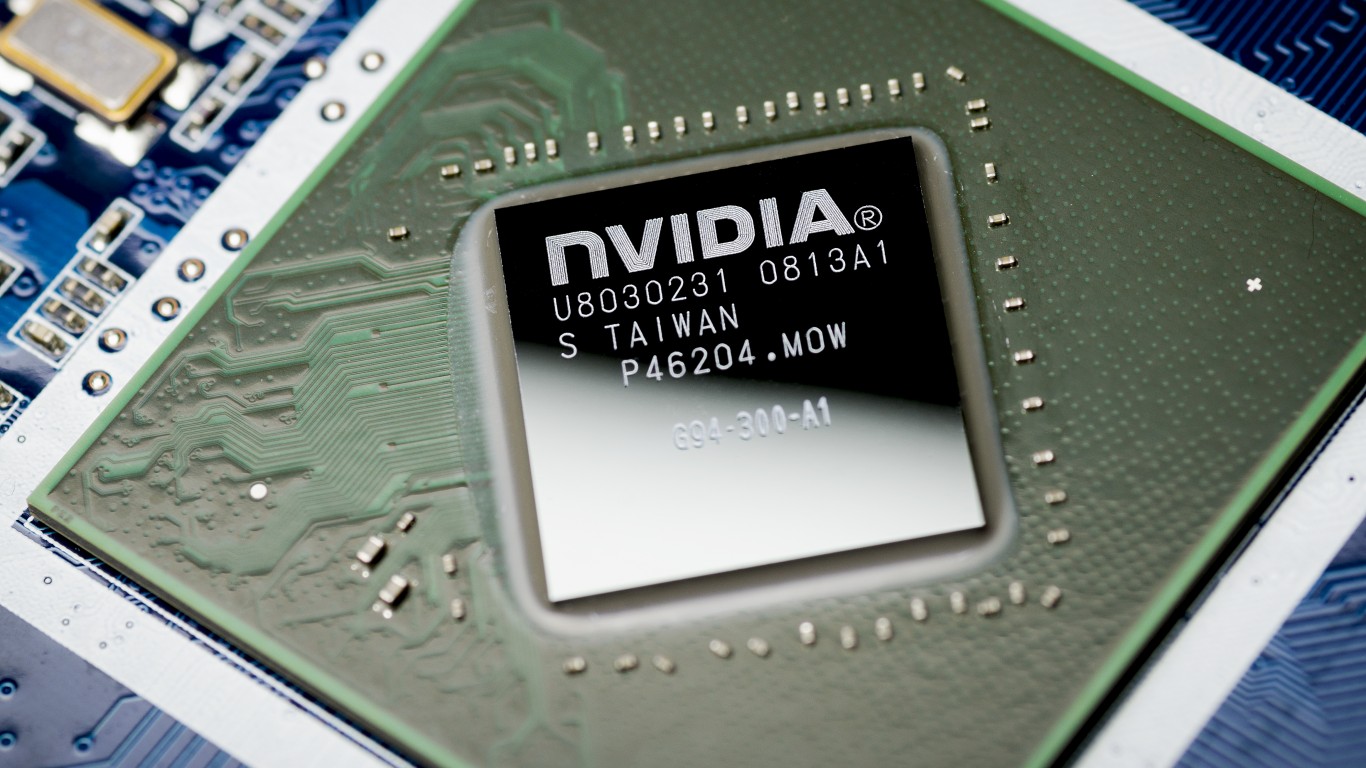

The S&P 500 is approaching 6,600 and could reach 7,000 by early next year if current momentum persists. Tech and AI performance will likely need to drive further gains, with Nvidia and ASML highlighted as potential beneficiaries if the bull market continues. Remaining invested for the long term is advised over attempting market timing such as selling in May or September, since individual companies can outperform even in flat or declining markets. Elevated valuations suggest muted decade-ahead returns are possible, yet the AI revolution represents a major wild card that could justify higher valuations.

Read at 247wallst.com

Unable to calculate read time

Collection

[

|

...

]