#exxonmobil

#exxonmobil

[ follow ]

fromFortune

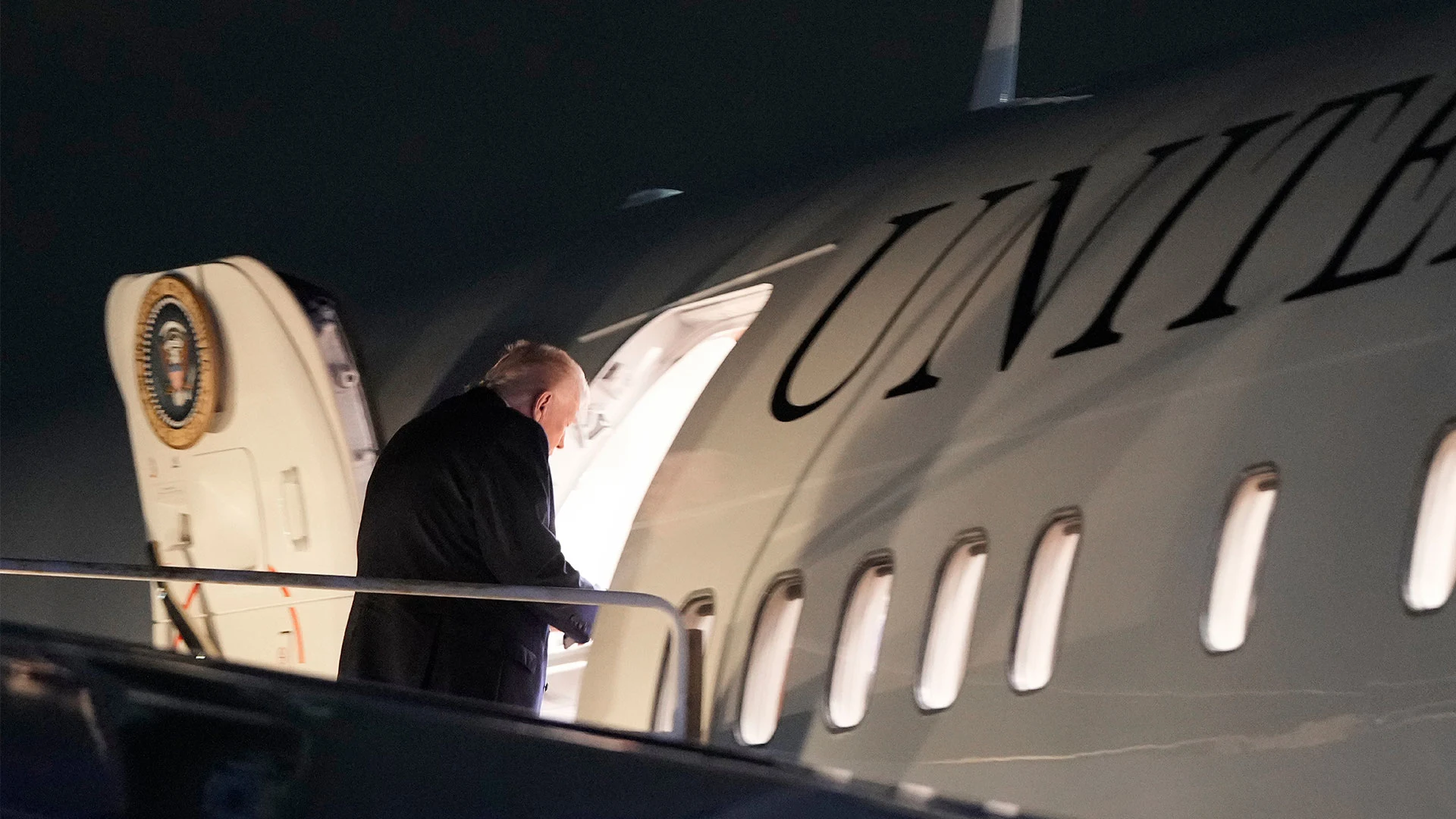

2 weeks agoTrump threatens to keep 'too cute' Exxon out of Venezuela after CEO provides reality check on 'univestable' industry | Fortune

As other oil executives lavished President Trump with praise at the White House, Exxon Mobil CEO Darren Woods bluntly said the Venezuelan oil industry is currently "univestable," and that major reforms are required before even considering committing the many billions of dollars required to revitalize the country's dilapidated crude business. Two days later, a miffed Trump told reporters Jan. 11 that he would "probably be inclined to keep Exxon out" of Venezuela. "I didn't like their response. They're playing too cute," Trump said.

US politics

from24/7 Wall St.

3 weeks agoSell Exxon Stock Immediately

Venezuela is supposed to be the amazing future of big oil. After all, about one-fifth of the world's proven oil reserves sit in and under land and water it controls. These are vast new fields for Exxon Mobil Corp. ( NYSE: XOM) and Chevron Corp. ( NYSE: CVX). Not so fast. As the United States seized Venezuelan dictator Nicolás Maduro, word went out that President Trump will gather oil executives at the White House.

World news

fromwww.bbc.com

2 months agoUK government will not financially support Mossmorran

A spokesman for the global energy company said there was not a "competitive future" for the site because of the UK's current economic and policy environment combined with market conditions. Deputy First Minister Kate Forbes said the Scottish government would support workers, and the Grangemouth investment taskforce would be expanded to also consider the future of the Mossmorran site. Exxon Mobil said 179 directly employed jobs will be at risk, along with 250 contractors.

UK politics

fromLos Angeles Times

3 months agoExxon sues California over new laws requiring corporate climate disclosures

ExxonMobil has filed suit in federal court challenging two California laws that would require the oil giant to report the greenhouse emissions resulting from the use of its products globally. The 30-page complaint, filed Friday in the U.S. District Court for the Eastern District of California, argues that the laws violate the company's free speech rights by requiring it to "trumpet California's preferred message even though ExxonMobil believes the speech is misleading and misguided."

Environment

from24/7 Wall St.

9 months agoWhy Exxon Mobil (NYSE: XOM) and Chevron (NYSE: CVX) Stocks Are Trading Higher Today

Despite a generally tough year for oil stocks, ExxonMobil and Chevron are showing resilience against market volatility, bolstered by rising crude oil futures and favorable geopolitical factors.

Cryptocurrency

[ Load more ]