UK news

fromLondon Business News | Londonlovesbusiness.com

1 day agoThree million taxpayers could face a 100 penalty from HMRC - London Business News | Londonlovesbusiness.com

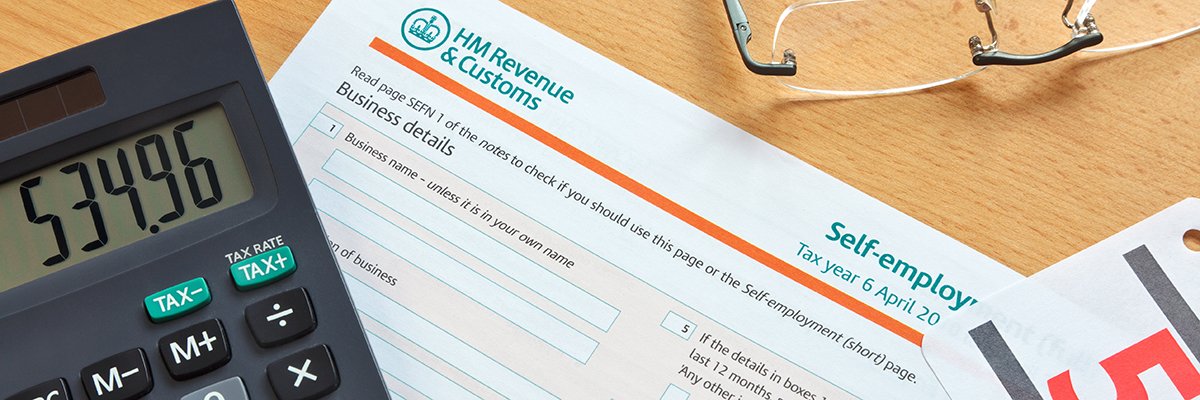

Taxpayers who miss the 31 January Self‑Assessment filing deadline face a £100 late-filing penalty plus 7.75% interest and a potential 5% surcharge on unpaid tax.