#legal-fees

#legal-fees

[ follow ]

#insurance-reform #jpmorgan-chase #charlie-javice #jpmorgan #fraud-conviction #rob-bonta #litigation #defamation

fromVulture

2 weeks agoMichael Jackson's Estate Executors Want to Make Paris Jackson Pay

"These payments appear, at least in part, to consist of lavish gratuities bestowed upon already well-compensated counsel," her motion argued. "As painful as it is to say in print, the present records suggest a group of closely-knit, highly-compensated lawyers is exploiting Executors' lack of oversight to skim money from the Estate, in plain view."

US news

fromFortune

4 weeks agoJPMorgan says Javice firms billed millions just for 'attendance' | Fortune

A previously sealed Delaware court filing released Monday offered the most detailed picture yet of JPMorgan's claim that Javice, who was convicted in March of defrauding the largest US bank in a $175 million deal, abused a 2023 order requiring it to cover the costs of her defense. JPMorgan is seeking to avoid $10.2 million in disputed charges and end the requirement that it pay future bills.

Law

Business

fromBusiness Insider

1 month agoMartinis, seafood, and a plastic cup: The zany expenses at the center of JPMorgan's latest dispute with Charlie Javice

JPMorgan seeks to stop advancing $18 million in Charlie Javice's legal fees, alleging excessive food, alcohol, and travel charges after her fraud conviction.

California

fromsfist.com

2 months agoState AG Rob Bonta Dragged Back Into Sheng Thao Scandal, With Claims There Is Compromising' Video of Him

A witness alleges compromising video links Attorney General Rob Bonta to the Sheng Thao scandal while Bonta has spent roughly $468,000–$500,000 on legal defense.

California

fromThe Mercury News

2 months agoAG Rob Bonta spent nearly $500k on lawyers while trying to be 'helpful' amid East Bay corruption probe, advisor says

California Attorney General Rob Bonta spent $468,000 in campaign funds on legal fees while interviewed by federal investigators in an East Bay corruption probe.

fromFortune

3 months agoJPMorgan balks at $115 million legal tab for convicted fraudsters and says Charlie Javice's lawyers are treating it 'like a blank check' | Fortune

According to the filing, Javice's team of lawyers across five law firms have billed JPMorgan approximately $60.1 million in legal fees and expenses, while Amar's lawyers have billed the bank roughly $55.2 million in fees. In total, the bank alleges Javice and Amar's lawyers have racked up legal fees of $115 million, with one law firm receiving $35.6 million in reimbursements alone.

US news

US politics

fromLos Angeles Times

4 months agoLawyers who hit L.A. City with whopping bill on homeless case to get $4 million more

Los Angeles City Council approved raising Gibson Dunn's contract to nearly $5 million despite concerns about steep legal bills and a previously approved $900,000 contract cap.

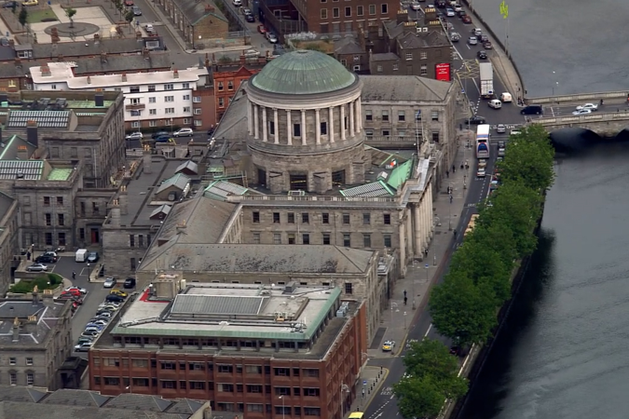

fromIrish Independent

7 months agoInjuries Resolution Board proposes rethink on whether it can sanction the paying of legal fees

The Injuries Resolution Board has called on the Government to consider changing the law to allow it to sanction the paying of legal fees, which would avoid costly legal bills.

Intellectual property law

US politics

fromAbove the Law

8 months agoMorning Docket: 05.27.25 - Above the Law

Trump and his allies are discussing how to influence firms on key matters despite denials of authority.

Texas' new legislative plan risks incurring vast legal expenses for taxpayers.

Ed Martin may pardon individuals related to the Whitmer kidnapping plot.

Judges in Texas law schools teach a conservative interpretation of the Constitution.

[ Load more ]