#student-debt

#student-debt

[ follow ]

#higher-education #college-affordability #public-service-loan-forgiveness #education #housing-affordability

US politics

fromFortune

1 week agoAs Trump throws a bone to Gen Z on student debt, watchdog calls it an 'incoherent political giveaway,' straight out of Biden's playbook | Fortune

The Trump administration indefinitely paused collection of defaulted federal student loan debt, extending pandemic-era relief and drawing criticism from fiscal watchdogs.

Higher education

fromFortune

2 weeks ago1 in 3 college grads admit their degrees weren't financially worth it-now they can't save for retirement because they're drowning in debt | Fortune

A significant portion of graduates face heavy student debt and lower-than-expected entry salaries, leaving many financially worse off and delaying major life steps.

fromFast Company

4 weeks agoU.S. consumer watchdog faces extinction in 2026 as Trump says it's 'very important' to shut it down

Her student debt had been double-counted, making it look as though she owed a quarter of a million dollars and putting home ownership out of reach. Jones disputed the items with Experian, one of the major credit reporting agencies, multiple times in writing and over the phone, but got nowhere. "They kept saying it's been verified, it's been verified...They never investigated. They never tried to remove it," Jones said in an interview.

US politics

Real estate

fromwww.housingwire.com

4 weeks agoThe debt crisis among younger Americans: How it is shaping homeownership and what lenders can do

Rising student loans, credit card debt, and holiday spending are delaying homeownership for Millennials and Gen Z, pushing more young adults to seek financial counseling.

fromBusiness Insider

1 month agoTrump is taking on America's college debate

The four-year college degree no longer has the same pull it once did - and the Trump administration agrees. The Department of Education concluded its negotiations on the Workforce Pell program on December 12, a new initiative included in President Donald Trump's "big beautiful" spending legislation. The program would extend Pell grants to low-income borrowers in short-term certification programs, with the intention of providing more funding for alternative paths to a four-year college degree or trade school.

Higher education

fromJezebel

1 month agoGambling Is Ubiquitous Because People Know America Is a Scam

The dirty secret many now understand is that a lot of wage labor is not enough to get by in America anymore. The past promise of working hard for 40 hours per week and getting a home and a retirement in return is gone for a significant chunk of this country, stripped away by capitalists whose only desire in their miserable lives is to have more than they currently do.

US politics

Higher education

fromFortune

1 month agoParents are sacrificing retirement, taking second jobs, and liquidating investments just to afford college for their kids | Fortune

Parents are jeopardizing their retirements and savings to pay college costs, often using risky measures like 401(k) loans, second jobs, and halted investing.

Real estate

fromSlate Magazine

2 months agoWhen My Ex Walked Out on Me and Our Twins, I Was Devastated. I Had No Idea How Much My Finances Would Be, Too.

Single mother of twins struggles financially after divorce, shouldering mortgage, student loans, new credit-card debt, and limited disposable income.

Higher education

fromFortune

2 months agoLike Steve Jobs, this 55-year-old CEO attended community college-and he warns Gen Z 'don't let ego get in the way' when deciding their future | Fortune

Starting at community college can save money, build resourcefulness, and still lead to major career success when paired with fortitude and practical choices.

fromInside Higher Ed | Higher Education News, Events and Jobs

2 months agoNew Graduate Loan Caps Risk Reducing Access, Not Debt

setting in motion significant changes in student borrowing rules that will have huge implications for students, institutions and the economy. Among the negotiated points were directives in the One Big Beautiful Bill Act designed to address the $1.8 trillion student debt crisis by canceling Grad PLUS loans-used by many students to pay for grad school-and putting caps on the amount of money students can borrow: $200,000 for professional degrees, capped at $50,000 annually, and $100,000 for graduate programs, limited to $20,500 a year.

Higher education

fromAbove the Law

2 months agoThe 15 Most Expensive Law Schools (2024-2025) - Above the Law

We all know that a legal education can land the average law school graduate in up to six figures of debt (to be specific, on average, 2025 graduates racked up more than $112,500 in student debt), and we all know that egregiously high tuition costs are to blame. But which schools had the most costly tuition and fees for out-of-state students for the 2024-2025 academic year? The Short List blog of U.S. News has compiled a ranking for that, and it's not at all shocking that almost all 15 schools that made the list are private.

Education

US politics

fromBusiness Insider

2 months agoA 2020 email from Peter Thiel on why young people may turn on capitalism is circulating after Zohran Mamdani's win

Excessive student debt and unaffordable housing leave young people with negative capital, reducing their stake in capitalism and increasing support for socialism.

fromSlate Magazine

2 months agoHelp! My Friend and His Girlfriend Have a Devious Scheme to Pay Off Her Student Loans. It Involves a Wedding Ring.

A close friend, "Sam," and his girlfriend, "Emily," are doing something truly terrible. She has a lot of student debt to pay off, so they have come up with a plan. She will date and marry someone rich, and he will pay off her student loans, and then she will break up with him to be with Sam after a few years.

Relationships

#public-service-loan-forgiveness

Non-profit organizations

fromNon Profit News | Nonprofit Quarterly

8 months agoAdvocates Mobilize to Stave Off Cuts to Federal Student Loan Programs - Non Profit News | Nonprofit Quarterly

The recent legislative changes threaten public service workers' access to loan forgiveness programs, impacting students and low-income communities.

Careers

fromBusiness Insider

3 months agoI paid off $90,000 in student debt by living with my parents. I moved to Australia, have my own place, and a higher salary.

Gabriel Filer paid off over $90,000 in student debt in under four years by living with his parents and saving aggressively to relocate to Australia.

Higher education

fromFortune

3 months agoGen Z is snubbing college as a dismal job market and sky-high tuition forces them to weigh ROI: 'No schools are immune' | Fortune

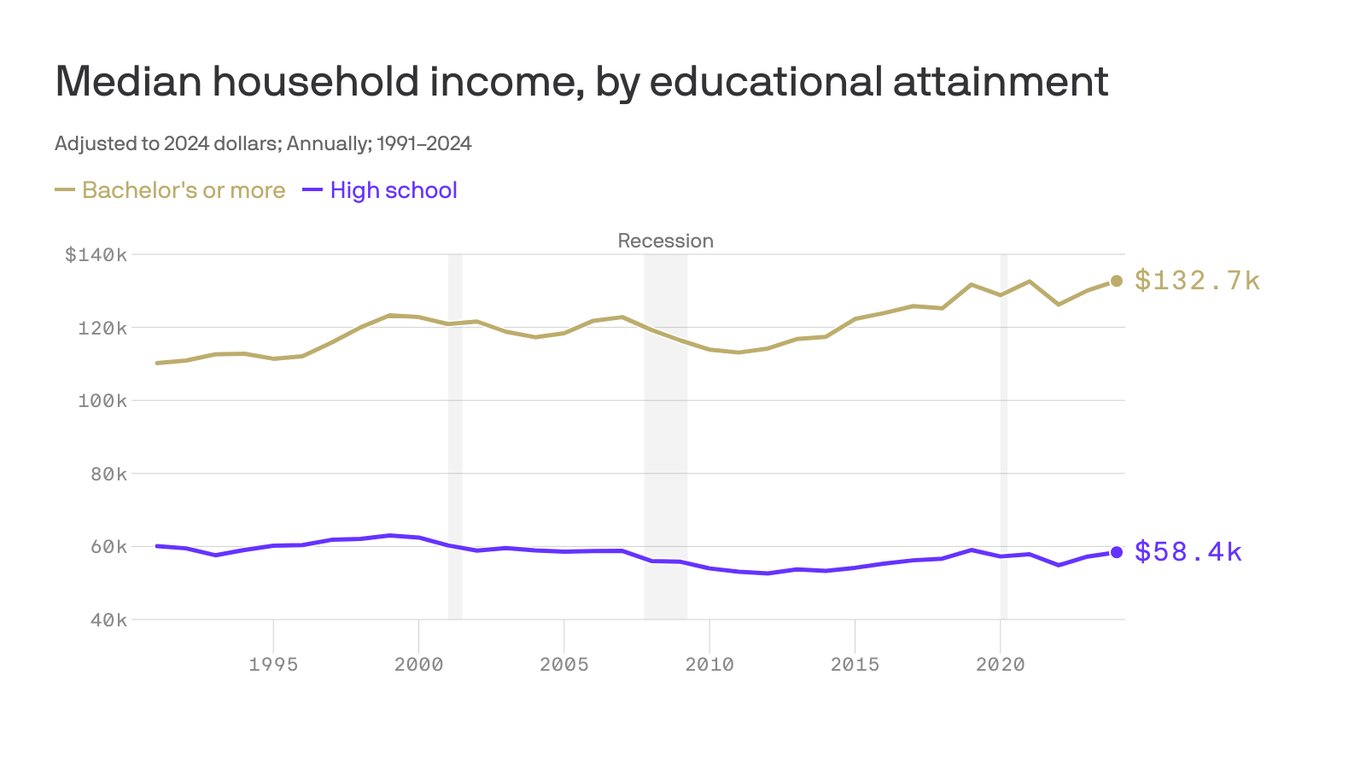

Many bachelor's degrees still provide positive long-term financial returns, but ROI varies widely by state, institution, and field amid rising costs and job-market risks.

fromwww.mercurynews.com

4 months agoOpinion: American dream? For millennials, that's a cruel joke.

According to the 2025 National Association of Realtors' Home Buyers and Sellers Generational Trends Report, 43% of younger millennials carry a median student debt of $30,000 with around 29% of older millennials having a median debt of $35,000. That's on top of the average millennial's credit card debt of $6,691, per Experian. Retirement? Seventy-five is optimistic. The American dream we were promised is behind us, and millennials, also known

Real estate

Higher education

fromBusiness Insider

4 months agoThe new Miss America said she was able to graduate from college '100% debt-free' because of pageants

Cassie Donegan graduated college debt-free after winning Miss America scholarships, including a $50,000 national prize and prior awards totaling at least $27,000.

fromwww.housingwire.com

5 months agoHomeowners worry 'Big Beautiful Bill' will impact student debt

Student loan balances have ballooned over the past 20 years, growing from $260 billion in 2004 to $1.6 trillion by 2025. According to a recent Point survey, 42% of American homeowners are currently paying student debt for themselves or a family member. Another 37% plan to take on student debt in the future including 10% who don't currently have any student debt.

Education

Education

fromBusiness Insider

6 months agoA recent Gen Z grad with $25,000 in student debt says his job search has made him accept he may never work in his dream field: 'I know that life isn't fair'

Solomon Jones, a recent graduate, faces difficulty in securing employment in his field due to economic factors and personal challenges.

fromEntrepreneur

7 months agoCollege Majors and Careers That Make the Most Money: Report | Entrepreneur

A typical student graduating from high school in 2025 could take on an estimated $40,000 in student loan debt before completing their college education, amidst rising interest rates.

Higher education

NYC parents

fromFortune

7 months agoParents are sacrificing retirement, taking second jobs, and liquidating investments just to afford college for their kids

Parents are making significant financial sacrifices for their children's college education, risking their own financial stability due to soaring tuition costs.

Online learning

fromBusiness Insider

8 months agoMy daughter is enrolled in an early college program while still in high school. It's a great way to save money on tuition.

The early college program provides high school students with an opportunity to earn college credits for free, helping them avoid future debt.

[ Load more ]