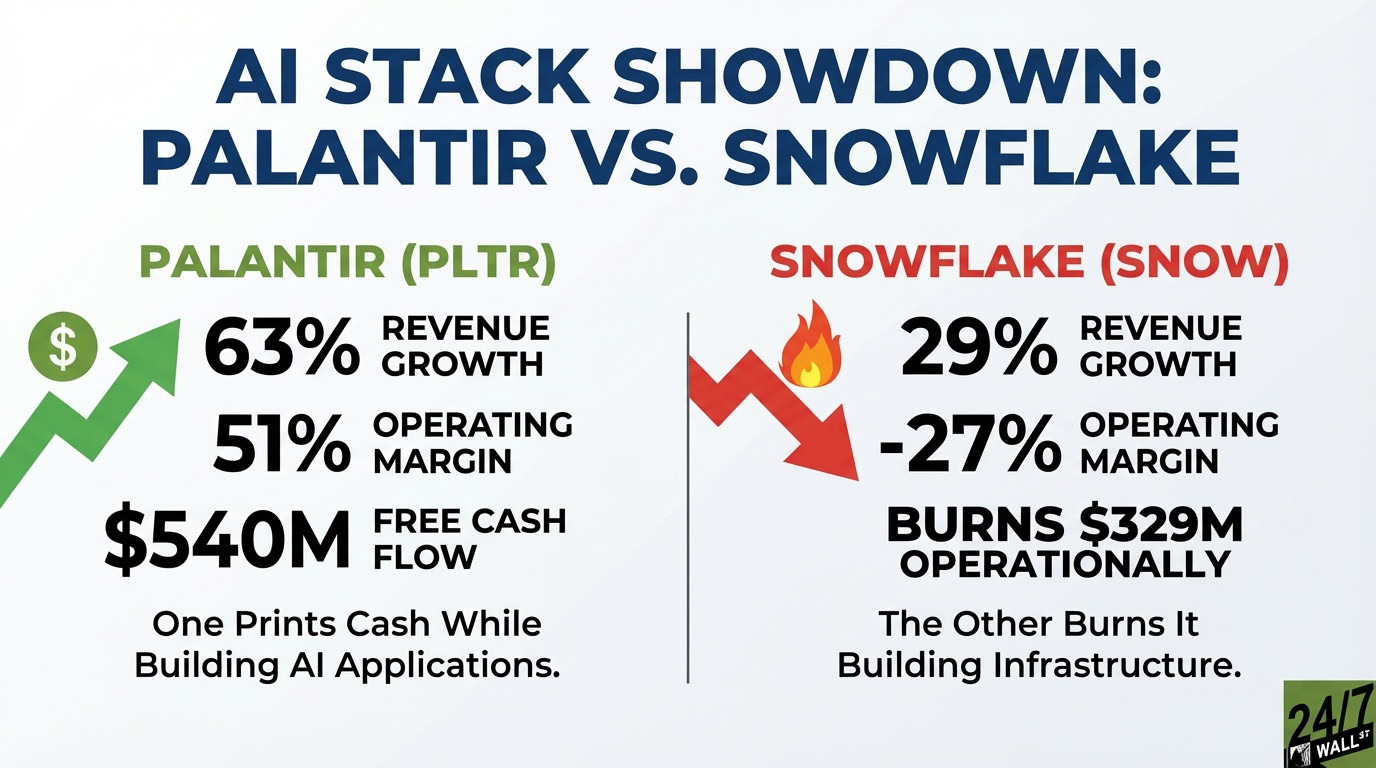

"Palantir ( NYSE: PLTR) and Snowflake ( NYSE: SNOW) just reported earnings revealing two companies attacking AI from opposite ends of the stack. Palantir posted 63% revenue growth with 51% operating margins. Snowflake grew 29% but burns cash with a negative 27% operating margin. One Prints Cash While Building AI Applications. The Other Burns It Building Infrastructure. Palantir's Q3 showed a company hitting escape velocity."

"Palantir bets AI value lives in production deployment, not model training. CTO Shyam Sankar: "The models are converging while pricing for inference is dropping significantly. This only strengthens our conviction that the value is in the application and workflow layer." AIP automates workflows. One insurance customer cut underwriting time from two weeks to three hours using 78 AI agents. Trinity Rail saw a $30 million bottom-line impact in three months."

Palantir posted 63% revenue growth, 51% operating margins, $393 million in operating income, and $540 million in free cash flow, exceeding $1 billion in trailing 12-month free cash flow. U.S. commercial revenue jumped 121% to $397 million and the Artificial Intelligence Platform (AIP) accelerates customers to seven-figure deals rapidly. Palantir emphasizes production deployment and workflow automation over model training, citing falling inference pricing and greater application-layer value. Snowflake grew revenue 29% to $1.21 billion with 125% net revenue retention and new large customers but recorded a negative 27% operating margin and a $329 million operational loss, though cash flow was $138 million positive.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]