#market-volatility

#market-volatility

[ follow ]

#bitcoin #federal-reserve #tariffs #us-china-trade #dividend-stocks #investment-strategies #risk-management #gold

fromFortune

1 week agoTime in the market is more powerful than timing the market | Fortune

When market volatility shakes our confidence and headlines scream uncertainty, I remind people that the real risk isn't the ups and downs-it's our reaction to them. In 2025, amid escalating global trade tensions, steep tariffs, stubborn inflation and a government shutdown, we've witnessed wave after wave of turbulence. Yet from decades in financial services, I've learned a simple truth: Your biggest risk isn't market volatility - it's how you respond to it. Rather than be reactive and try to time the market, it's important to stay the course.

Retirement

Business

fromFortune

1 week agoTop analyst still thinks we're on the cusp of a new boom for the economy, but investors aren't with him: 'markets remain choppy' | Fortune

U.S. economy is entering a rolling recovery with an early-cycle rebound, though investor jitters, muted guidance, tariffs, and bank earnings cloud near-term equity prospects.

Business

fromLondon Business News | Londonlovesbusiness.com

2 weeks agoUK stock markets fall as investors are 'spooked' - London Business News | Londonlovesbusiness.com

Concerns about US regional banks and liquidity pressures triggered a global market sell-off, dragging the FTSE, European indices, and major bank shares lower.

Business

fromFortune

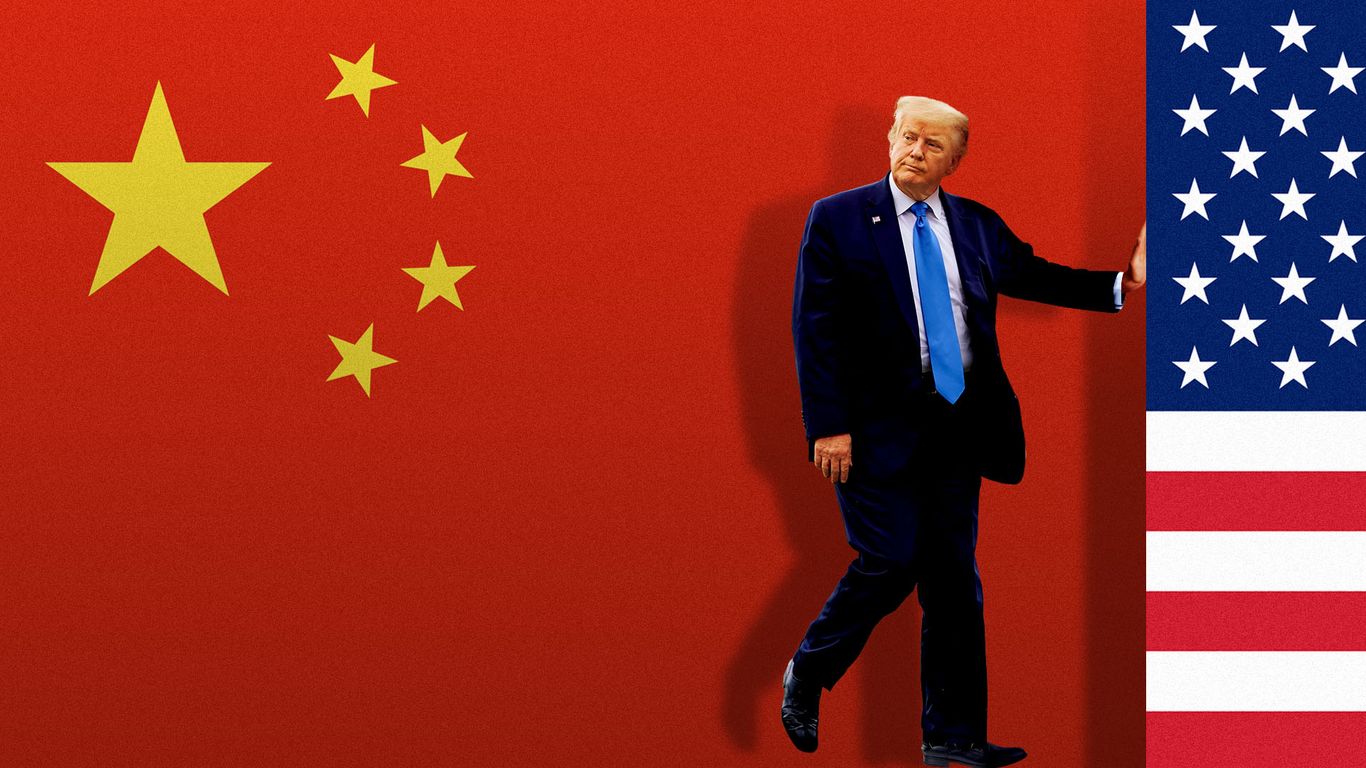

2 weeks agoTop analyst warns that 'larger than expected correction is likely' if Trump and China don't kiss and make up | Fortune

Renewed US-China trade tensions could trigger a larger-than-expected correction in U.S. equities, potentially dropping the S&P 500 10-15% if unresolved.

US politics

fromFortune

2 weeks agoMarkets expect Trump's latest China tariffs will backfire as gold jumps and the dollar 'is not looking looking healthy' | Fortune

U.S.–China tariff escalation and China's rare-earth limits hit markets: stocks fell, the dollar weakened, and gold rose as investors see tariffs backfiring on the U.S.

US news

fromABC7 Los Angeles

3 weeks agoWall Street drops to its worst day since April after Trump's threats of tariffs shatter its calm

U.S. stocks plunged after President Trump threatened massive tariff increases on China, triggering broad declines across major indexes and raising fears about overvalued markets.

Business

fromLondon Business News | Londonlovesbusiness.com

3 weeks agoAn analytical outlook on the future of the S&P 500 - London Business News | Londonlovesbusiness.com

Global financial markets face sharp volatility as investors reassess inflated tech/AI valuations while a U.S. government shutdown adds economic uncertainty.

US politics

fromFortune

4 weeks agoInvestors dumped U.S. assets overnight in favor of gold, Bitcoin, and foreign stocks as government shutdown leaves Wall Street 'flying blind' | Fortune

Government shutdown halted BLS release of jobless claims and CPI, prompting market volatility with falling S&P futures, dollar dip, and safe-haven asset gains.

fromLondon Business News | Londonlovesbusiness.com

1 month agoFTSE 100 gives back mining-led rally - London Business News | Londonlovesbusiness.com

Yesterday, Antofagasta led a charge by miners on the FTSE 100 to lift the index out of the early morning slump, shooting up about 9% after Freeport-McMoRan set out the production impact from the suspension of its Grasberg Block Cave mine in Indonesia, the world's second largest copper mine. The firm said it would lower third-quarter consolidated sales by approximately 4% for copper and 6% for gold compared to its July estimates.

Business

fromwww.mercurynews.com

1 month agoCryptocurrencies sink as $1.5 billion in bullish bets wiped out

Cryptocurrency traders saw more than $1.5 billion in bullish wagers liquidated on Monday, triggering a sharp selloff that hit smaller tokens hardest. Ether slumped as much as 9% to $4,075 as nearly half a billion dollars of leveraged long positions in the second-largest token were liquidated, according to data from Coinglass. Bitcoin declined 3% to $111,998 at one point. Coins like Solana, Algorand and Avalanche also slipped.

World news

from24/7 Wall St.

1 month ago2 September IPOs That Can Hit the Ground Running

Despite the stock market's incredible September surge, IPO season has been relatively tame, at least compared to the first half. Undoubtedly, it may come as a bit of a surprise to some to witness StubHub (NYSE:STUB) dropping immediately out of the gate, especially when you consider the secular trends surrounding live experiences. Either way, I think the initial disappointment could set the stage for a shining buying opportunity at some point down the road.

Venture

Tech industry

fromFortune

1 month ago$34 billion was wiped from Larry Ellison's net worth days after briefly becoming the world's richest as 'AI bubble' fears grow | Fortune

Larry Ellison's net worth surged $101 billion after Oracle's OpenAI cloud deal announcement, briefly making him the world's richest before a rapid $34 billion decline.

Business

fromLondon Business News | Londonlovesbusiness.com

1 month agoTrading tips for smarter entry and exit strategies in today's markets - London Business News | Londonlovesbusiness.com

Precise entry and exit timing, informed by market conditions and disciplined risk management, determines trading success in volatile fast-moving markets.

UK news

fromDataBreaches.Net

1 month agoJLR 'cyber shockwave ripping through UK industry' as supplier share price plummets by 55% - DataBreaches.Net

Autins shares plunged after a Jaguar Land Rover cyberattack halted production, materially disrupting Autins' operations and signaling wider automotive supply-chain impacts.

fromcointelegraph.com

1 month agoHow to turn crypto news into trade signals using Grok 4

The AI crypto market is projected to expand from $3.7 billion in 2024 to $46.9 billion by 2034, highlighting the increasing reliance on AI tools like Grok 4 for trading. Launched in mid-2025, Grok 4 quickly became one of the most visited AI tools, with active users rising by 17%, a trend expected to grow as traders adopt it. Unlike basic news aggregators, Grok 4 offers real-time news analysis, sentiment evaluation and DeepSearch to filter noise and extract actionable trading insights.

Cryptocurrency

fromFast Company

1 month agoThis week in business: Markets stumble, gold glitters, and burgers get cheaper

From corner offices to checkout lines, businesses are scrambling as shaky markets test prices, patience, and loyalty. Tech is still the flashpoint- AI is fueling record demand while doubling as cover for layoffs and financial gymnastics. IPOs are slowly coming back, but only for companies that can prove they've got the growth to back it up. Meanwhile, D.C. drama over tariffs and the Fed is shaking currencies, commodities, and investor confidence.

Business

from24/7 Wall St.

1 month agoThe September Effect: Time to Sell or a Chance to Buy Low?

Dubbed the " September Effect," this phenomenon sees the S&P 500 averaging a negative 0.8% return since 1926, the only month with a consistent negative average over nearly a century. Theories abound as to why: from portfolio rebalancing by institutional investors to tax-loss harvesting and post-vacation market jitters.

Business

US politics

fromLondon Business News | Londonlovesbusiness.com

1 month agoWall Street returns from day off to Smoot-Hawley tariff chatter, sterling hammered as gilt yields hit 27yr high - London Business News | Londonlovesbusiness.com

Tariff escalation risks deepening economic downturns, unsettles markets, and reflects global power politics exemplified by Smoot-Hawley and current tariff disputes.

fromFortune

2 months agoStock market's fate comes down to the next 14 trading sessions

The next few weeks will give Wall Street a clear reading on whether this latest stock market rally will continue - or if it's doomed to get derailed. Jobs reports, a key inflation reading and the Federal Reserve's interest rate decision all hit over the next 14 trading sessions, setting the tone for investors as they return from summer vacations.

Business

from24/7 Wall St.

2 months agoI Want To Retire at 50 With $5 Million But Need to Shift From Stocks to Bonds: How Do I Rebalance My Taxable Portfolio Efficiently?

Reevaluating a financial portfolio as retirement approaches is crucial for safeguarding against market volatility. A balanced approach helps ensure financial stability.

Retirement

fromLondon Business News | Londonlovesbusiness.com

2 months agoFamilies reclaim millions in overpaid inheritance tax - London Business News | Londonlovesbusiness.com

Over the past three years, families have made more than 18,000 claims for overpaid inheritance tax (IHT), with property sales contributing significantly to these claims.

Real estate

[ Load more ]