#ai-chips

#ai-chips

[ follow ]

#nvidia #export-controls #tsmc #china #amd #groq #openai #semiconductors #valuation #us-china-trade #national-security

fromTechzine Global

2 days agoAI focus propels MediaTek to record high

MediaTek's share price has risen sharply in a short period of time, partly due to increasing attention to the company's role in Google's AI strategy. In two trading days, the share price rose by approximately 19 percent. This brought the Taiwanese chip designer to a new record high on the Taipei stock exchange. The jump in share price follows a period of sustained optimism among investors.

Tech industry

fromTechCrunch

1 week agoAnthropic's CEO stuns Davos with Nvidia criticism | TechCrunch

"The CEOs of these companies say, 'It's the embargo on chips that's holding us back,'" Amodei said, incredulous, in response to a question about the new rules. The decision is going to come back to bite the U.S., he warned. "We are many years ahead of China in terms of our ability to make chips," he told Bloomberg's editor-in-chief, who was interviewing him. "So I think it would be a big mistake to ship these chips."

Artificial intelligence

US politics

fromBusiness Insider

1 week agoTrump places a 25% tariff on high-end computing chips, and said more duties may be coming for the semiconductor industry

A 25% tariff on certain advanced AI chips, including Nvidia H200 and AMD MI325X, aims to boost US tech manufacturing and cites national security.

fromFast Company

3 weeks agoCES 2026: Day 1 roundup of the coolest tech on display

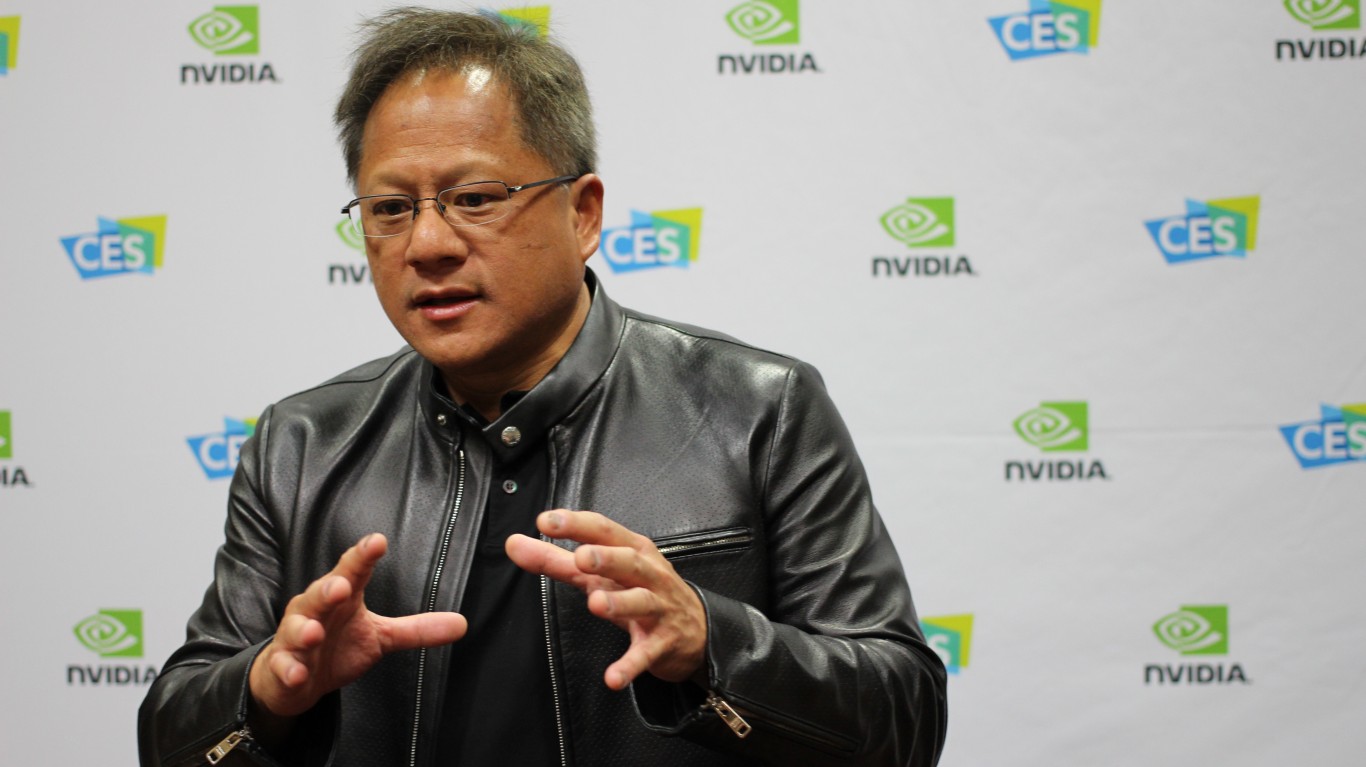

CEO Jensen Huang showed off Cosmos, an AI foundation model trained on massive datasets, capable of simulating environments governed by actual physics. He also announced Alpamayo, an AI model specifically designed for autonomous driving. Huang revealed that Nvidia's next generation AI superchip platform, dubbed Vera Rubin, is in full production, and that Nvidia has a new partnership with Siemens. All of this shows Nvidia is going to fight increased competition to retain its reputation as the backbone of the AI industry.

Tech industry

Artificial intelligence

fromYanko Design - Modern Industrial Design News

1 month agoHow AI Will Be Different at CES 2026: OnDevice Processing and Actual Agentic Productivity - Yanko Design

AI is shifting from cloud-based demos to on-device infrastructure, driving new AI-optimized chips and agentic systems that act on users' behalf.

fromBusiness Insider

1 month agoChina's economic slump isn't stopping a billionaire boom in AI chips

On Wednesday, shares of MetaX Integrated Circuits Shanghai - a GPU startup founded by former AMD executives - skyrocketed as much as 755% on their first day of trading on the Shanghai Stock Exchange's tech-focused STAR Market, before closing up about 700%. The surge catapulted its chairman and cofounder, Chen Weiliang, into one of China's fastest-rising tech moguls. Chen's stake in MetaX is worth about $6.5 billion, according to the Bloomberg Billionaires Index.

Tech industry

fromTESLARATI

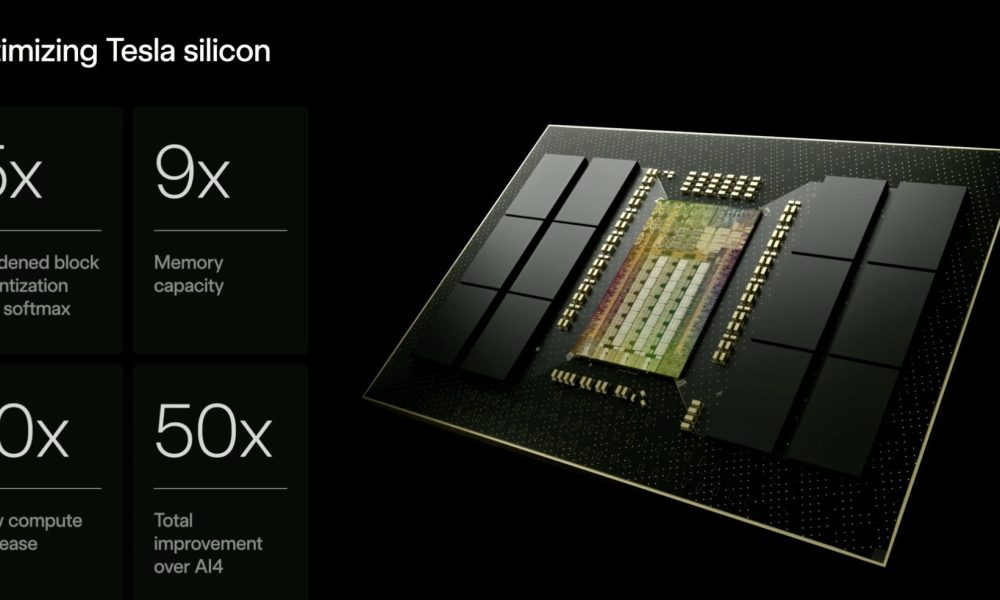

1 month agoTesla supplier Samsung preps for AI5 production with latest move

TSMC is the other. TSMC is using its 3nm process, reportedly, while Samsung will do a 2nm as a litmus test for the process. The different versions are due to the fact that 'they translate designs to physical form differently,' CEO Elon Musk said recently. The goal is for the two to operate identically, obviously, which is a challenge. Some might remember Apple's A9 'Chipgate' saga, which found that the chips differed in performance because of different manufacturers.

Artificial intelligence

fromFortune

1 month agoNvidia CEO says data centers take about 3 years to construct in the U.S., while in China 'they can build a hospital in a weekend' | Fortune

If you want to build a data center here in the United States from breaking ground to standing up a AI supercomputer is probably about three years,

Artificial intelligence

[ Load more ]