#federal-reserve-independence

#federal-reserve-independence

[ follow ]

fromLondon Business News | Londonlovesbusiness.com

6 days agoDollar consolidates near multi-week highs - London Business News | Londonlovesbusiness.com

The US dollar remained in a consolidation phase on Thursday, holding close to multi-week highs. Inflation data released on Wednesday painted a broadly stable picture. Producer prices increased moderately on the month. Taken together with earlier CPI data, inflation trends appear neither re-accelerating nor cooling decisively. Retail sales provided a contrasting signal, rebounding strongly in November. Improved consumer spending, suggesting household demand remains relatively healthy, limiting immediate downside risks to growth.

US news

fromFortune

1 week agoBitcoin closes in on $100,000 in surprise surge | Fortune

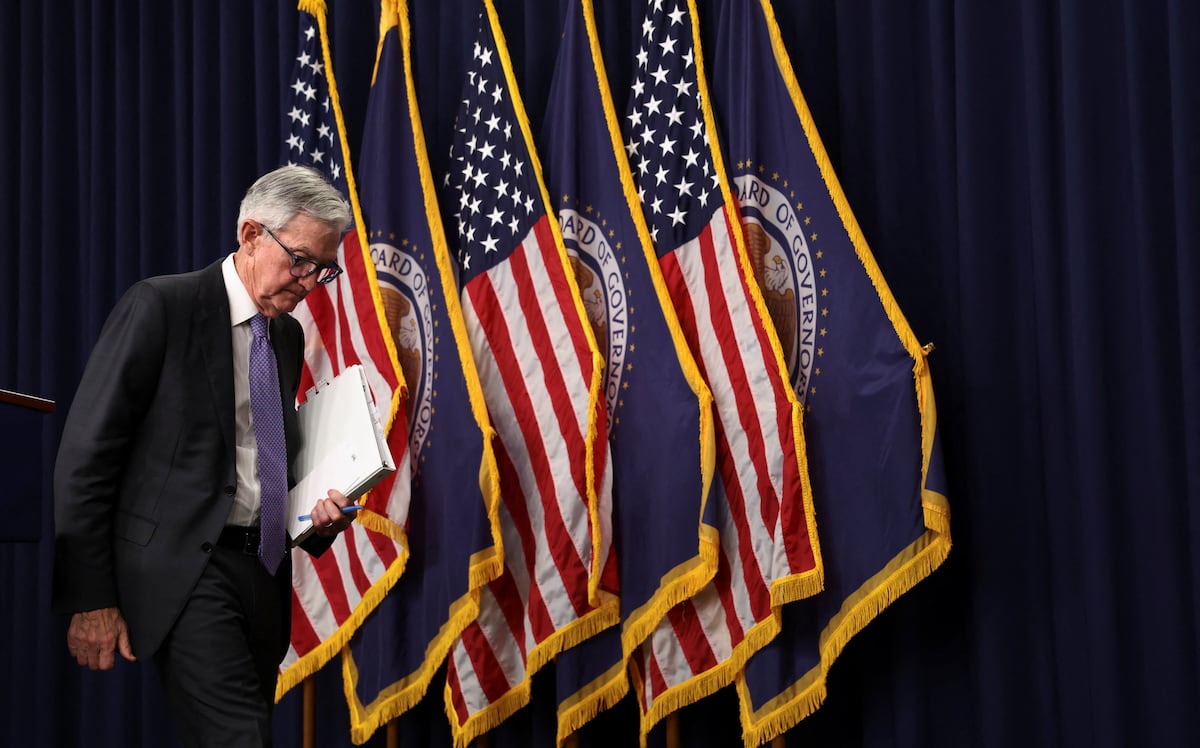

On Wednesday, the original cryptocurrency surpassed $97,000 for the first time in two months and is up more than 6% in the last week. The jump in Bitcoin came after Federal Reserve Chair Jerome Powell issued a remarkable statement that accused President Donald Trump's administration of directing a baseless criminal investigation at him in order to intimidate the agency. Meanwhile, the price of gold and other precious metals shot up as investors fled towards safe haven assets.

World news

fromFortune

1 week agoWhy Fed independence is doomed regardless of the Trump/Powell drama, top economist says | Fortune

Yet, Monday came, and while gold and silver went vertical, equities stayed calm and the dollar barely drifted. To economist Tyler Cowen, the renowned libertarian from George Mason University and author of the influential Marginal Revolution blog, this lack of market panic is the most revealing part of the drama. It isn't that investors trust the administration's motives; it's that they have already accepted the "ugly little truth" that the Federal Reserve's independence is a relic of a bygone era.

US politics

fromLondon Business News | Londonlovesbusiness.com

1 week agoTrump's midterm concerns drive raft of policy announcements - London Business News | Londonlovesbusiness.com

The FTSE 100 appears to be faring best, benefitting from strong gains in the precious metals space and defence stocks. Notably, the weekend newswires told of a potential military deployment into Greenland from the likes of Germany and the UK in a bid to deter Trump's overtures for the island. While Trump's apparent willingness to take aim at land owned by a fellow Nato member does highlight the need for Europe to ramp up defence spending,

Miscellaneous

US politics

fromLondon Business News | Londonlovesbusiness.com

1 week agoDollar slumps as Fed independence comes under fire - London Business News | Londonlovesbusiness.com

Concerns about the Federal Reserve's independence after reports of a criminal investigation into Chair Jerome Powell weakened the US dollar and raised market volatility risks.

US politics

fromwww.theguardian.com

4 months agoDonald Trump maelstrom likely to leave US economic model unrecognisable | Heather Stewart

Trump's economic policy is inconsistent and combines tariffs, government stakes, corporate interventions, and attacks on regulators, undermining established economic norms.

fromwww.theguardian.com

4 months agoUS justice department reportedly opens criminal inquiry into Fed governor Lisa Cook

Lawyers with the justice department have issued subpoenas for the investigation, according to the Wall Street Journal. Last month, Trump moved to fire Cook over unconfirmed claims that she listed two properties as her primary residence. Bill Pulte, the director of the Federal Housing and Finance Agency and a close ally of Trump, alleged Cook had lied on bank documents and records to obtain a better mortgage rate.

US politics

US politics

fromFortune

4 months agoThe Fed's independence is hanging by a thread, and this 'nuclear' scenario would signal 'things are truly going off the rails,' economists say

A presidential attempt to remove a Fed governor threatens Federal Reserve independence and risks higher inflation and borrowing costs if political control forces rate cuts.

US politics

fromLondon Business News | Londonlovesbusiness.com

4 months agoUSD/JPY between Fed constraints and political turbulence: Where is it heading above 147.50?

USD/JPY edges higher amid doubts as U.S. dollar turmoil from Trump's dismissal of a Fed member threatens Fed independence and boosts safe-haven yen demand.

US politics

fromwww.aljazeera.com

4 months agoWill Trump's latest attack on the Fed erode central bank's independence?

President Trump intends to remove Federal Reserve Governor Lisa Cook over alleged mortgage fraud, potentially expanding presidential influence over the Fed and threatening central bank independence.

Business

fromLondon Business News | Londonlovesbusiness.com

4 months agoSilver consolidates near historic highs - London Business News | Londonlovesbusiness.com

Silver remained near multi-year highs amid political uncertainty, potential Fed policy shifts, strong solar-driven industrial demand, and sizable ETP inflows supporting prices.

[ Load more ]