#healthcare-costs

#healthcare-costs

[ follow ]

#retirement-planning #social-security #government-shutdown #affordable-care-act #financial-planning #inflation

#retirement-planning

Retirement

from24/7 Wall St.

6 months agoMy Dad Is Retiring Soon - How Can I Get Health Insurance Before I Miss Important Appointments?

Healthcare costs can drastically impact retirement finances, creating substantial fears for retirees.

Having a financial backup plan can mitigate risks associated with unexpected expenses in retirement.

fromsfist.com

1 week agoThursday Morning What's Up: Darrell Issa May Relocate to Texas Due to Prop 50

Notorious California GOP Rep. Darrell Issa says he may move to Texas after Prop 50 will likely make it impossible for him to win another election here. "I have to go where I can be of the most use," he said. [Bay Area News Group] A new poll suggests voters will be very unhappy with Republicans if their healthcare premiums spike next year. [New York Times]

California

fromwww.npr.org

2 weeks agoMedicare negotiated lower prices for 15 drugs, including 71% off Ozempic and Wegovy

"President Trump directed us to stop at nothing to lower health care costs for the American people," said Health and Human Services Secretary Robert F. Kennedy, Jr., in a press release. "As we work to Make America Healthy Again, we will use every tool at our disposal to deliver affordable health care to seniors."

US news

fromwww.housingwire.com

2 weeks agoWill increases in health insurance premiums threaten homebuying?

Hale said the scale of the hit for families losing ACA subsidies is likely to be severe if the subsidies are discontinued. It's going to mean that healthcare takes a bigger chunk out of their monthly budget, and that budget shift has got to come from somewhere, she said. So, for people who are currently renting and maybe saving up to buy a home, that (saving) progress might feel like the most discretionary part of their budget and probably would be a target.

US politics

Healthcare

fromwww.theguardian.com

1 month agoI'm as capitalist as they get but Medicare for all is the best hope for US healthcare | Gene Marks

Expanding Medicare into a national health insurance system with employer and employee contributions could reduce costs and simplify the complex, expensive U.S. healthcare system.

fromwww.housingwire.com

1 month agoFed interest rate cut odds drop amid inflation concerns

By my assessment, the labor market is largely in balance, the economy shows continued momentum, and inflation remains too high, the statement read in part. I view the stance of policy as only modestly restrictive. In this context, I judged it appropriate to maintain the policy rate at this week's meeting. The federal funds rate is currently at a range of 3.75% to 4%, its lowest level in three years.

US politics

US politics

fromLGBTQ Nation

1 month agoPete Buttigieg nails the real reason why Donald Trump's ballroom is so troubling - LGBTQ Nation

President Trump prioritized constructing a gilded White House ballroom while Americans face rising health insurance premiums and hardship from an extended government shutdown.

fromSFGATE

2 months agoYou'll Struggle To Live Well in Alaska on Just Your Social Security, Even If Your Mortgage Is Paid Off

Retirees in Alaska face one of the harshest financial gaps in the nation when attempting to live on Social Security alone. According to a Realtor.com® analysis of median Social Security benefits by state and the Elder Economic Security Standard Index, the average retiree in Alaska experiences an annual shortfall of $4,152, or about $346 per month, even with their mortgage fully paid. While that might not seem like a lot to some, it could mean all the difference to someone on a fixed income.

Public health

fromFast Company

2 months agoGLP-1s are reshaping bodies and budgets

But that same morning, a $900 charge for her GLP-1 prescription landed on her credit card. Whatever she was saving at the supermarket felt dwarfed by the cost of her medication. Drugs like Ozempic, Wegovy, Mounjaro, and Zepbound are being hailed as medical breakthroughs. They're not just changing waistlines-they're changing household budgets. And as these shifts ripple through everyday spending, the financial industry has an important role to play in helping people rethink, rebalance, and plan for this new reality.

Public health

US politics

fromwww.mediaite.com

2 months agoTrump Shreds Fox News and Peter Doocy Over Interview With Senate Democrat Demands Fox Get On Board Or Get Off Board NOW'

President Trump accused Fox News and Peter Doocy of unchallenged promotion of Senator Mark Kelly on healthcare, alleging network bias and demanding corrective action.

US politics

fromCbsnews

2 months agoFDA commissioner says TrumpRx is a "major step" toward making prescription medications affordable

A Trump administration-Pfizer agreement via the TrumpRx platform aims to lower U.S. prescription drug prices by offering medications at discounts comparable to European rates.

fromHarvard Gazette

2 months agoHarvard's healthcare plans: What's changing, what's staying the same - Harvard Gazette

Harvard has not adjusted the proportion of healthcare costs paid by Harvard and the employee for 10 years, despite rapidly rising healthcare costs. Therefore, after a series of conversations with the community and recommendations to University leaders, we are beginning the process of making modest adjustments to co-payments (co-pays) and deductibles on a more regular basis. These adjustments will help make sure that the proportion of costs paid for by Harvard

Higher education

fromFortune

2 months agoThe American Dream has a price tag: at least $5 million. And don't forget that college degree | Fortune

The cost of achieving the American Dream in 2025 has soared past $5 million, according to a comprehensive analysis by Investopedia, marking a staggering milestone in the financial realities facing U.S. households today. This figure represents the cumulative lifetime expenses of eight pillars of middle-class aspiration, and stands nearly $600,000 higher than last year's estimate, and almost 50% more than just two years ago.

US news

fromwww.theguardian.com

2 months agoThis is the hardest I've ever lived': meet the US cowgirls making it as ranchers

Savanah McCarty was not riding across the wide-open prairie when a horse accident nearly killed her. She was in the driveway of her leased farm outside Bozeman, Montana, waiting for a student's mother to arrive, when her horse seized and flipped over backwards, landing on top of her. The horse, it turned out, had a neurological disorder linked to possum urine. McCarty never imagined it could cause this.

Agriculture

fromNature

2 months agoCan Diet and Exercise Really Prevent Alzheimer's?

When Juli comes home after work, her husband doesn't regale her with stories about his photography business the way he once did. Instead he proudly shows her a pill container emptied of the 20 supplements and medications he takes every day. Rather than griping about traffic, he tells her about his walk. When they go out to a favorite Mexican restaurant, he might opt for a side salad instead of tortilla chips with his quesadilla. "He's actually consuming green food, which is new," says Juli, who asked to be identified by only her first name to protect her husband's privacy.

Health

fromwww.mercurynews.com

2 months agoLetters: UC leadership should resign after handing over names

As the UC system asks its supporters to stand up against the federal government's demand for $1 billion from UCLA, it throws 160 of its own under the bus. In a cynical act of self-service, UC's leadership has given the names of those who practiced free speech, endangering their lives and livelihoods. As a Berkeley alum, I am appalled by this decision.

California

fromwww.npr.org

2 months agoIs telehealth a good idea, or should I see my regular doctor?

You can schedule appointments within hours sometimes minutes of realizing you need care and see a doctor from your couch, in your pajamas. Do you have a medical question you'd like an honest answer on? Write us at thrive@npr.org, and we'll consider your question for the column. But there can also be some serious drawbacks. For one, you might get hit with unexpected costs. And for medical conditions that aren't straightforward, there can be real benefits from building a relationship with a doctor IRL.

US news

fromLondon Business News | Londonlovesbusiness.com

5 months agoPlanning for the future: Peace of mind through thoughtful coverage - London Business News | Londonlovesbusiness.com

Insurance designed for older individuals differs from the types typically associated with earlier phases of life. These policies tend to emphasize peace of mind over wealth accumulation.

Healthcare

UK news

from24/7 Wall St.

6 months agoWhy Do We Feel Poor Despite Higher Incomes? A Deep Dive Into American Financial Perceptions

Despite higher incomes, Americans often feel financially poor due to lack of government support for necessities like healthcare.

Wealth perception affects individual financial confidence, regardless of actual income levels.

fromMedCity News

8 months agoJPMorgan: How Small and Mid-Sized Businesses Make Healthcare Decisions - MedCity News

Across our data, we have seen how small businesses manage with limited resources, suggesting that they often have to make difficult tradeoffs. Increasing health care costs can have that effect - we saw that the firms with the largest health insurance burden increases were the most likely to drop coverage.

Healthcare

Alternative medicine

fromwww.nytimes.com

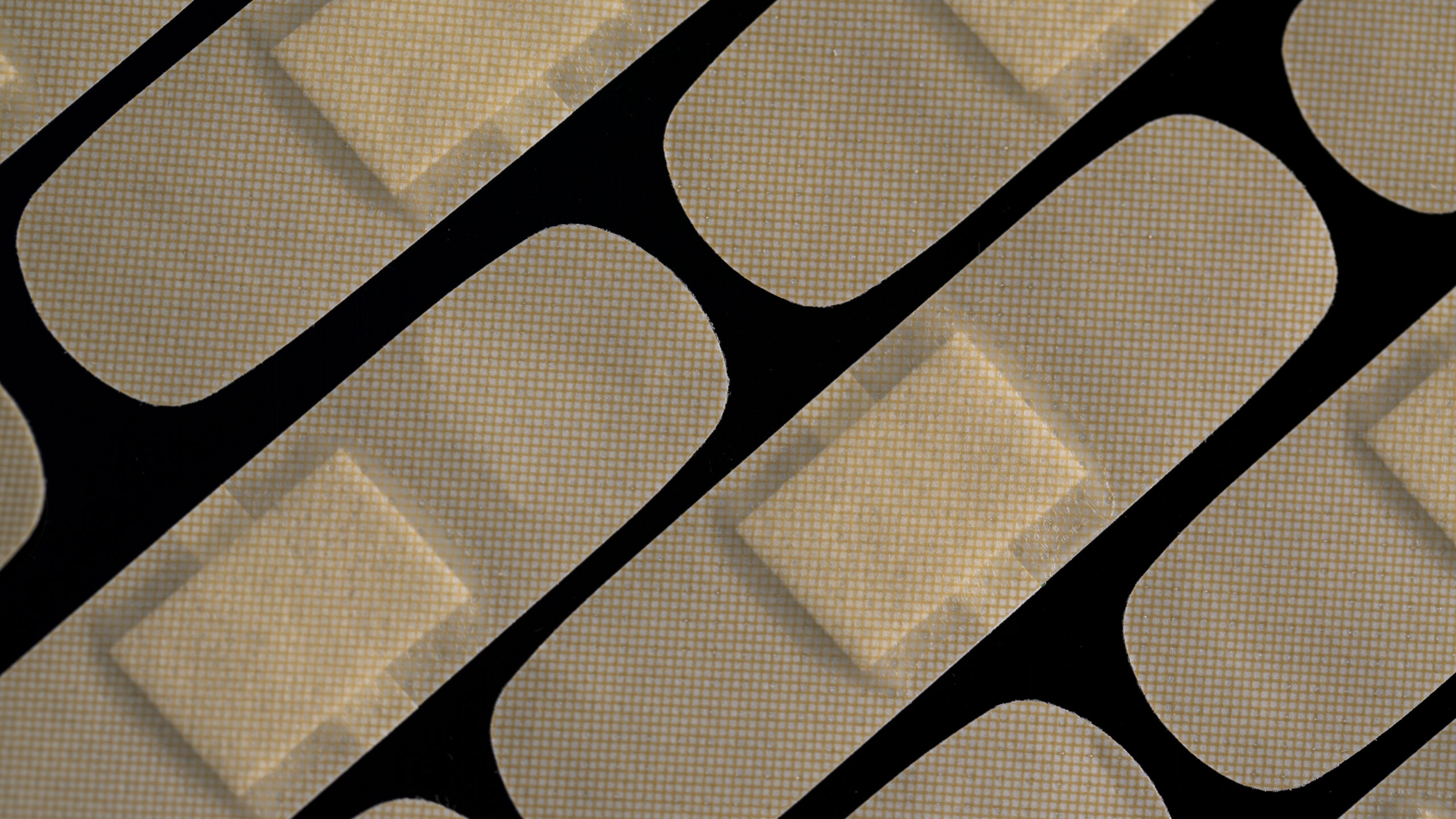

7 months agoPatients Cut Off From Cheaper Obesity Drugs as FDA Halts Sales of Copycats

FDA's crackdown on cheap weight-loss drugs threatens access for many Americans, raising treatment costs.

Compounded versions of Wegovy and Zepbound to be phased out as shortages are declared over.

[ Load more ]