#interest-rates

#interest-rates

[ follow ]

#federal-reserve #inflation #monetary-policy #labor-market #stock-market #bank-of-england #jerome-powell

UK politics

fromwww.independent.co.uk

2 days agoInterest rate cut next week nailed on' as UK economy grows just once in seven months

Economic contraction in October increases likelihood of a Bank of England interest rate cut to 3.75%, while The Independent emphasizes accessible journalism funded by donations.

from24/7 Wall St.

3 days agoWhy XRP Could Hit $3 in 2026

XRP (CRYPTO:XRP) is one of the top-10 tokens I continue to pay very close attention to. Much of that has to do with this network's underlying technology, its overall business model, and the value the XRP Ledger provides in facilitating cross-border transactions like few other networks can. Indeed, much of the broader thesis around crypto adoption really stems from the ability for retail and institutional entities to transfer value across the globe in a very efficient and low-cost manner.

Business

fromwww.theguardian.com

4 days agoBank of England expects budget will cut inflation by up to half a percentage point

The Bank of England expects Rachel Reeves's budget will reduce the UK's headline inflation rate by as much as half a percentage point next year. In a boost for the chancellor after last month's high-stakes tax and spending statement, Clare Lombardelli, a deputy governor at the central bank, said its early analysis showed the policies would lower the annual inflation rate by 0.4 to 0.5 percentage points for a year from mid-2026.

UK politics

from24/7 Wall St.

5 days agoWhy 2026 Could Be the Breakout Year for Dividend Growth Investors

Dividend growth investing has always had an appeal to people who are looking to boost their income, find stability in another unstable market, and build long-term wealth. However, 2026 is shaping up to be something of a turning point as a breakout year for this growing investment philosophy. Between market conditions, earnings trends, and a shift in investor sentiment, 2026 is setting up to be an environment where companies that raise their dividends annually will take a step back into the limelight.

Business

from24/7 Wall St.

1 week agoAre You Making Dave Ramsey's Biggest Retirement Mistake? 3 Questions to Ask Before You Quit Working.

The core mistake is retiring without true readiness. Retiring with debt is the biggest issue that Ramsey encounters . "You can't have a $750 F-150 payment," he said. "You can't have a student loan that's been around so long you think it's a pet." If you want to retire, get rid of that debt, and it will be much smoother. Otherwise, that debt can dent your income significantly, especially if you let it compound or if that debt carries a floating rate.

Retirement

Business

fromFortune

1 week agoFed officials like the mystique of being seen as financial technocrats, but it's time to demystify the central bank | Fortune

Interest rates are the price of time and should adjust to investment supply and demand; the Fed sets short-term targets but doesn't control market rates.

UK news

fromLondon Business News | Londonlovesbusiness.com

1 week agoCan cash ISAs keep pace with inflation? What the data shows - London Business News | Londonlovesbusiness.com

Falling Bank of England rates risk Cash ISA returns nearing or falling below inflation, potentially causing real-term losses for many UK savers.

Real estate

fromwww.housingwire.com

2 weeks agoThe originator's playbook: Competing and growing in a shifting market

Easing interest rates and renewed borrower confidence are driving originators to use adaptable, creative strategies, emphasizing client education, relationships, and non-QM solutions to regain momentum.

from24/7 Wall St.

2 weeks agoBoomers Are Flocking to These 3 Utility Stocks for Yields Above 6%

as they not only pay a fat yield but can also deliver upside. Utility companies are not directly exposed to tariffs, while being exposed to tailwinds from the AI buildout. Plus, ongoing interest rate cuts are adding another incentive for investors to buy and hold these stocks. Treasury yields are set to trend lower as a result of these rate cuts, so investors are naturally gravitating towards high-yield stocks.

Business

fromFast Company

3 weeks agoAre we in a K-shaped economy? Delayed employment numbers could reveal recession odds

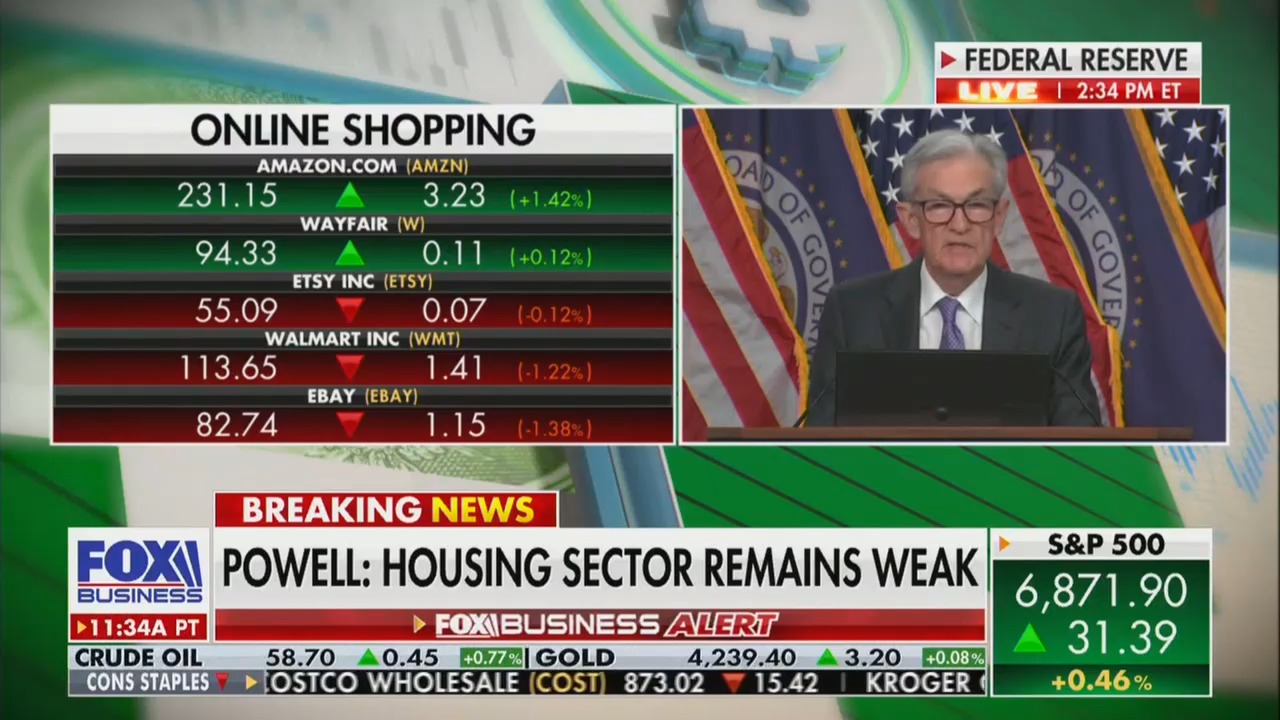

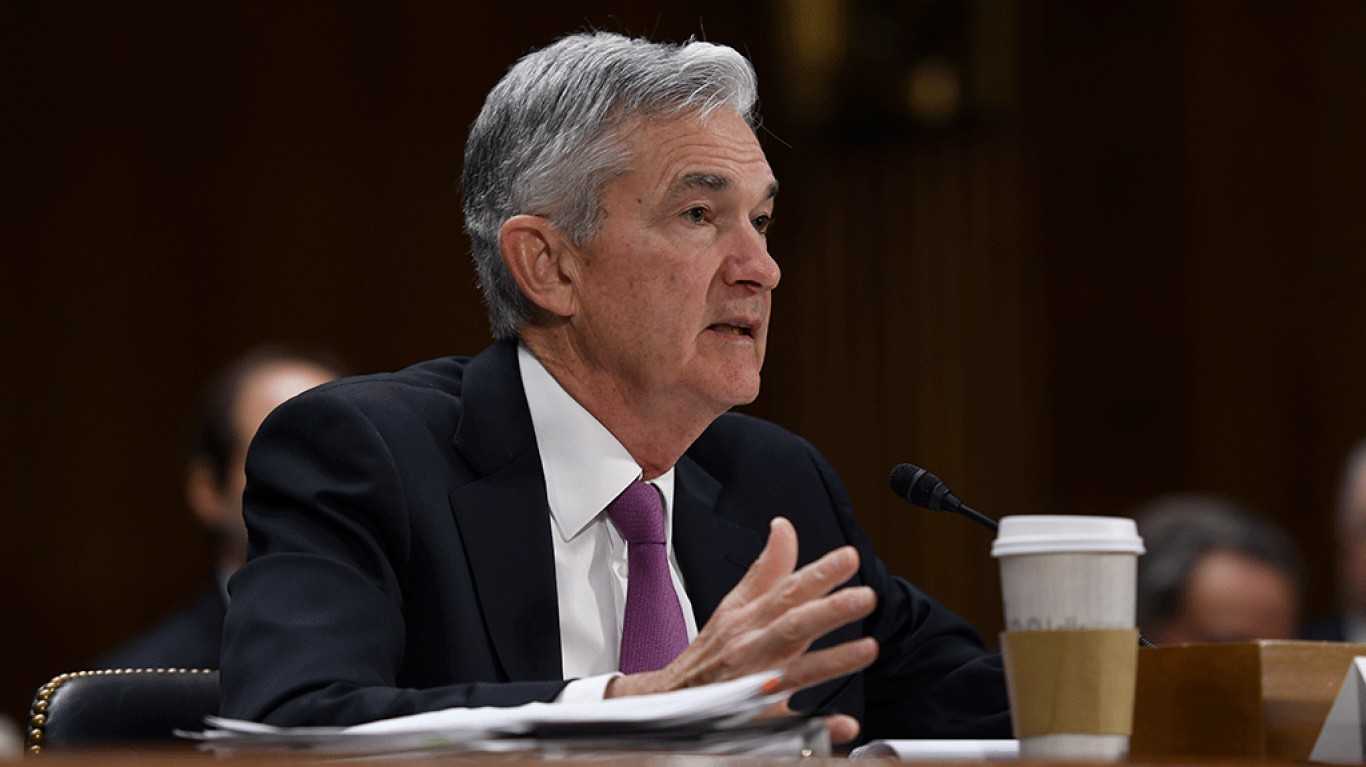

The gap between the richest and poorest Americans is widening in what Federal Reserve Chairman Jerome Powell has called a " bifurcated economy," as the cost of living skyrockets from housing to food prices, but wages for most workers remain stagnant. Basically, high-income individuals are doing well, while lower-income consumers are struggling more and more. That situation has sparked discussions about whether we're in a so-called "K-shaped economy."

Business

fromwww.mediaite.com

3 weeks agoI'd Love to Fire His A**!' Trump Declares That Fed Chair He Appointed Has Mental Problems'

Mortgage rates are down despite the fed. I mean, Scott, you've got to work on this guy. He's got some real mental problems. There's something wrong with him. Be honest. I would love to fire his ass. He should be fired. Guy is grossly incompetent. And he should be sued for spending $4 billion to build a little building. I'm building a ballroom that's going to cost a tiny fraction of that and it's bigger than the whole thing put together.

US politics

fromBusiness Insider

3 weeks agoLowe's says shoppers are sticking to small projects as the home-renovation slump drags on

Some Lowe's customers are spending on relatively affordable improvements to their homes, CEO Marvin Ellison said on the retailer's third-quarter earnings call on Wednesday. Such purchases include water heaters, kitchen sinks, and windows, executives said on the call. Sales in those areas have also benefited as Lowe's has digitized more of its sales process and added new product selections in some categories, executives said.

Remodel

[ Load more ]