#national-debt

#national-debt

[ follow ]

#fiscal-policy #trump-administration #republican-party #economic-policy #elon-musk #tax-policy #tax-cuts

fromFortune

1 week ago'This is a bad idea made worse': Senate Dems' plan to fix Obamacare premiums adds nearly $300 billion to deficit, CRFB says | Fortune

With enhanced Affordable Care Act (ACA) subsidies due to expire within days, some Senate Democrats are scrambling to protect millions of Americans from getting the unpleasant holiday gift of spiking health insurance premiums. The CRFB says there's just one problem with the plan: it's not funded. "With the national debt as large as the economy and interest payments costing $1 trillion annually, it is absurd to suggest adding hundreds of billions more to the debt," CRFB President Maya MacGuineas wrote in a statement on Friday afternoon.

US politics

fromwww.bbc.com

3 weeks agoCould the Budget help turn Generation Z into generation debt?

Some have argued keeping the national debt down protects the financial interests of younger people. That's because if the country's debt went up drastically, it is younger people who would have to foot the bill to pay for the interest on it. And it would be taken directly from their payslips through higher taxes. Generation Z, or those born between 1997 and 2012, have been hit in the pocket over the past 15 years by benefit cuts and dramatic increases in university tuition fees.

UK politics

fromFortune

3 weeks agoThe $38 trillion national debt 'milestone' and the accounting mirage | Fortune

But as someone who was elected to the U.S. Congress in 1984 on the very platform of fiscal responsibility-and who was the first practicing CPA ever elected to Congress-I want to sound a more fundamental warning: the number may be much less meaningful than meets the eye. We will never truly know what the national debt really is, or tackle it effectively, unless we adopt full-GAAP accounting at the federal level.

US politics

Business

from24/7 Wall St.

1 month agoWill the Stock Market Crash Before Thanksgiving? 6 Moves for Investors to Make Now

Historic market crashes show stocks can plunge dramatically; current high valuations, inflation, geopolitical wars, massive national debt, and AI hype could trigger significant declines.

US politics

fromFortune

1 month agoLegendary DC diplomat feels 'like Paul Revere' about the $38 trillion national debt: 'The crisis is coming!' | Fortune

The $38 trillion U.S. national debt, roughly 125% of GDP, constitutes a national security crisis by crowding out defense and other productive spending.

World news

fromFortune

1 month agoGovernments are likely to pillage the $80 trillion Great Wealth Transfer to help balance their national debt burdens, says UBS | Fortune

A multi-decade transfer of tens of trillions in inheritances will reshape household wealth, influence investment flows, and provide governments potential funding for national debts.

from24/7 Wall St.

2 months agoFrom $2.9 billion to $36 Trillion, See Which US Presidents Added The Most To the US Debt

"National debt" is a term thrown around quite frequently during political discussions. This often-staggering figure is the amount of money a country owes its creditors. But what or who constitutes as a creditor to a major nation? These can include institutions both overseas and at home, as well as other foreign countries. Though any sort of debt is generally painted in a negative light, national debt is normal and often goes along with a healthy economy; it can even help stimulate growth.

US politics

fromFortune

3 months agoThis 'economic sugar high' won't last, CRFB warns, touting analysis predicting long-term stagnation and $600 billion of annual borrowing through 2028

According to the detailed assessment from the nonpartisan budget watchdog, OBBBA will deliver a significant boost to economic output in the near term, with estimates showing growth rates could climb by nearly 1% in 2026, driven by increased demand and one-time incentives for labor and investment. However, the organization stresses this burst of activity is fleeting and warns projected long-term growth will stagnate as additional borrowing burdens the economy.

US politics

fromLondon Business News | Londonlovesbusiness.com

3 months agoChancellor may have been thrown a life line as public borrowing falls - London Business News | Londonlovesbusiness.com

UK public sector borrowing dropped to £1.1bn in July, the lowest July borrowing for three years, as stronger tax revenues slowed the increase in public borrowing. The uplift in receipts was largely driven by a better-than-expected economic performance in the first half of the year. Despite this improvement, borrowing for the financial year to date remains £6.7bn higher than the same period last year.

UK politics

US politics

fromwww.mediaite.com

3 months agoFox News Analyst Wrecks Trump's Economy in Post Shilling For Gold: Dollar is Crumbling' and Debt Has Exploded'

A promotion linked inflation, a weakening dollar, and rising national debt to urging gold and silver investments and offering IRA-to-physical-metals rollover guidance.

fromwww.mediaite.com

4 months agoMTG Throws Shade at Fox News' Elderly Baby Boomer' Audience: That's Not the Future of America'

When he goes on Fox News, the network where he hosts his show, and calls me crazy and refers to Marjorie Taylor Greene and her ilk, well he's insulting my entire district.

US politics

US politics

fromFortune

4 months agoRay Dalio issues his most dire warning to America yet: The ballooning $37 trillion deficit will trigger an 'economic heart attack'

Ray Dalio warns America faces an impending debt crisis likened to an economic heart attack, urging return to fiscal discipline of the 1990s.

fromAxios

4 months agoVenmo a gift to help pay Uncle Sam's debt? You can, if you really want

Since late 1996, individual donations through the Treasury Department's 'Gifts to Reduce the Public Debt' program have totaled $67.3 million, which represents roughly 20 minutes of debt accumulation.

US politics

fromwww.mediaite.com

5 months agoHouse Republican Revels in People Losing Medicaid Thanks to Trump's Bill: Just Some Americans That Aren't Americans'

I don't have any faith and confidence in the CBO, Nehls said, who was smoking a cigar and had both hands wrapped in bandages. They're scoring, they're wrong half the damn time.

US politics

fromwww.mercurynews.com

5 months agoLetters: Donald Trump's Big Beautiful Bill' attacks our most vulnerable

Republican lawmakers are supporting a budget bill that threatens health care for vulnerable populations, risks rural hospitals, and escalates climate damage, while favoring the wealthy.

US politics

fromwww.mediaite.com

6 months agoRand Paul Says He's Lost A Lot of Respect I Once Had for Donald Trump' After His Family Was Uninvited to White House Picnic

I think I'm the first senator in the history of the United States to be uninvited to the White House picnic. I just find this incredibly petty.

US politics

#donald-trump

US politics

fromwww.mediaite.com

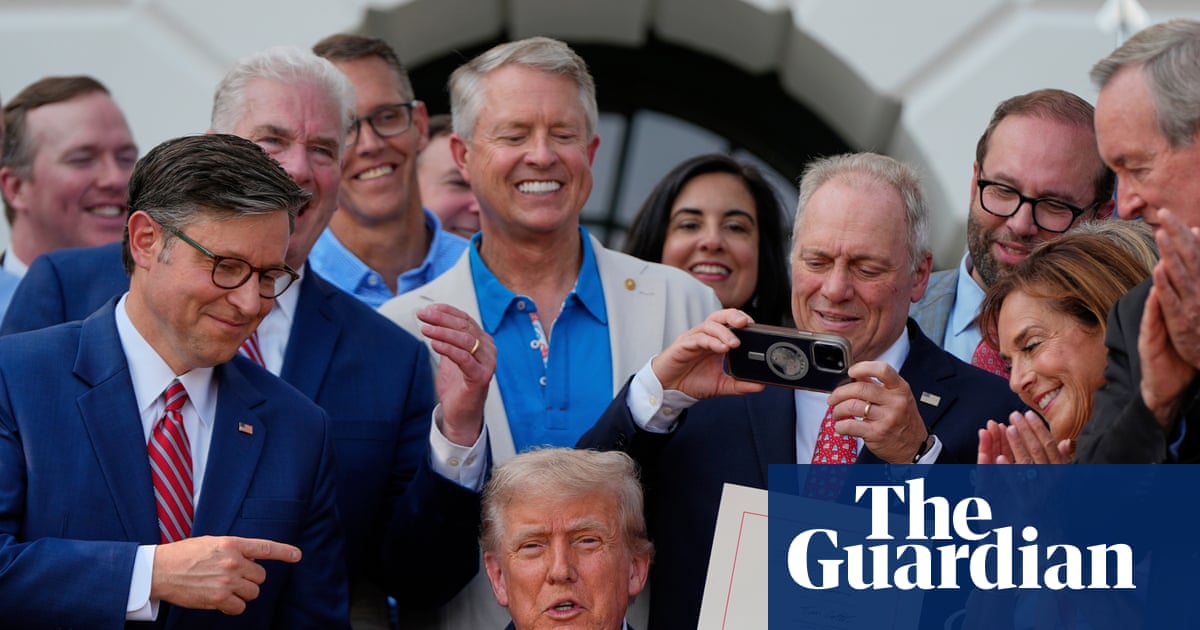

6 months agoTrump Nukes House Republican Worried His Big, Beautiful Bill Adds Too Much Debt: He Should Be Voted Out of Office'

Trump defends his fiscal policies against Massie's criticism, asserting his commitment to fixing the country's financial issues despite concerns about added debt.

Cryptocurrency

from24/7 Wall St.

8 months agoThe Most Important Questions Americans Should Be Asking About the National Debt

Understand the national debt's size and its implications for the economy.

Identify who holds the national debt and their influence on policy.

Recognize the potential risks of defaulting on national debt.

Know the role of Treasury securities in financing the debt.

[ Load more ]