#us-china-relations

#us-china-relations

[ follow ]

#tariffs #rare-earths #export-controls #taiwan #trade-war #nuclear-testing #tiktok #trade-negotiations #ai-chips

fromFortune

1 week agoChina makes history with $1 trillion trade surplus for first time ever | Fortune

China's exports rebounded in November after an unexpected contraction the previous month, pushing its trade surplus past $1 trillion for the first time, according to data released Monday. Exports climbed 5.9% from a year earlier in November while imports rose just under 2%. The customs data released on Monday also showed that shipments to the U.S. dropped nearly 29% year-on-year. But as trade with the U.S. weakens, China is diversifying its export markets throughout Southeast Asia, Africa, Europe and Latin America.

World news

fromenglish.elpais.com

2 weeks agoTikTok's first data center in Latin America will be in Brazil and will run entirely on wind power

TikTok, one of the world's most popular social media platforms, announced Wednesday that it will build its first data center in Latin America in Brazil, near the city of Fortaleza. The project represents a $38 billion investment. The Chinese company's supercomputers, which have revolutionized the internet with their short videos that are followed by hundreds of millions of users, will be operational in 2027 and will be powered exclusively by 100% renewable energy, according to a TikTok statement.

World news

fromThe Washington Post

4 weeks agoCongressional committee urges swift action on escalating Chinese threats

An influential bipartisan congressional commission is urging lawmakers to create a new economic statecraft office to enforce U.S. sanctions, limit Chinese influence in the electrical grid, and release funding to maintain dominance in cyber and quantum technologies - warning that the national security threat from Beijing has escalated over the past year and could threaten the United States in a future conflict.

US politics

fromInside Higher Ed | Higher Education News, Events and Jobs

1 month agoTrump Defends Enrolling International Students

You don't want to cut half of the people, half of the students from all over the world that are coming into our country-destroy our entire university and college system-I don't want to do that,

US politics

US politics

fromwww.mediaite.com

1 month agoTrump Defends Plan to Bring in Hundreds of Thousands of Chinese Students: I Know What MAGA Wants Better Than Anybody Else'

Trump defended admitting large numbers of Chinese students, arguing international enrollment is necessary to sustain many U.S. colleges and universities.

World politics

fromFortune

1 month agoTrump's seemingly offhand reference to a 'G2' hands status to China that it's been seeking for years | Fortune

President Trump's brief "G2" post signals a U.S. tilt toward acknowledging parity with China, pleasing Beijing and worrying U.S. allies about China's rising global influence.

World news

fromFortune

1 month agoTrump takes center stage at APEC-yet Asia's business leaders are optimistic that multilateralism will prevail | Fortune

APEC saw a cautious U.S.-China truce, renewed bilateral agreements in Asia, continued multilateral cooperation, and heightened focus on energy and economic diversification.

fromBusiness Matters

1 month agoUS and China agree final TikTok sale deal as part of wider trade framework

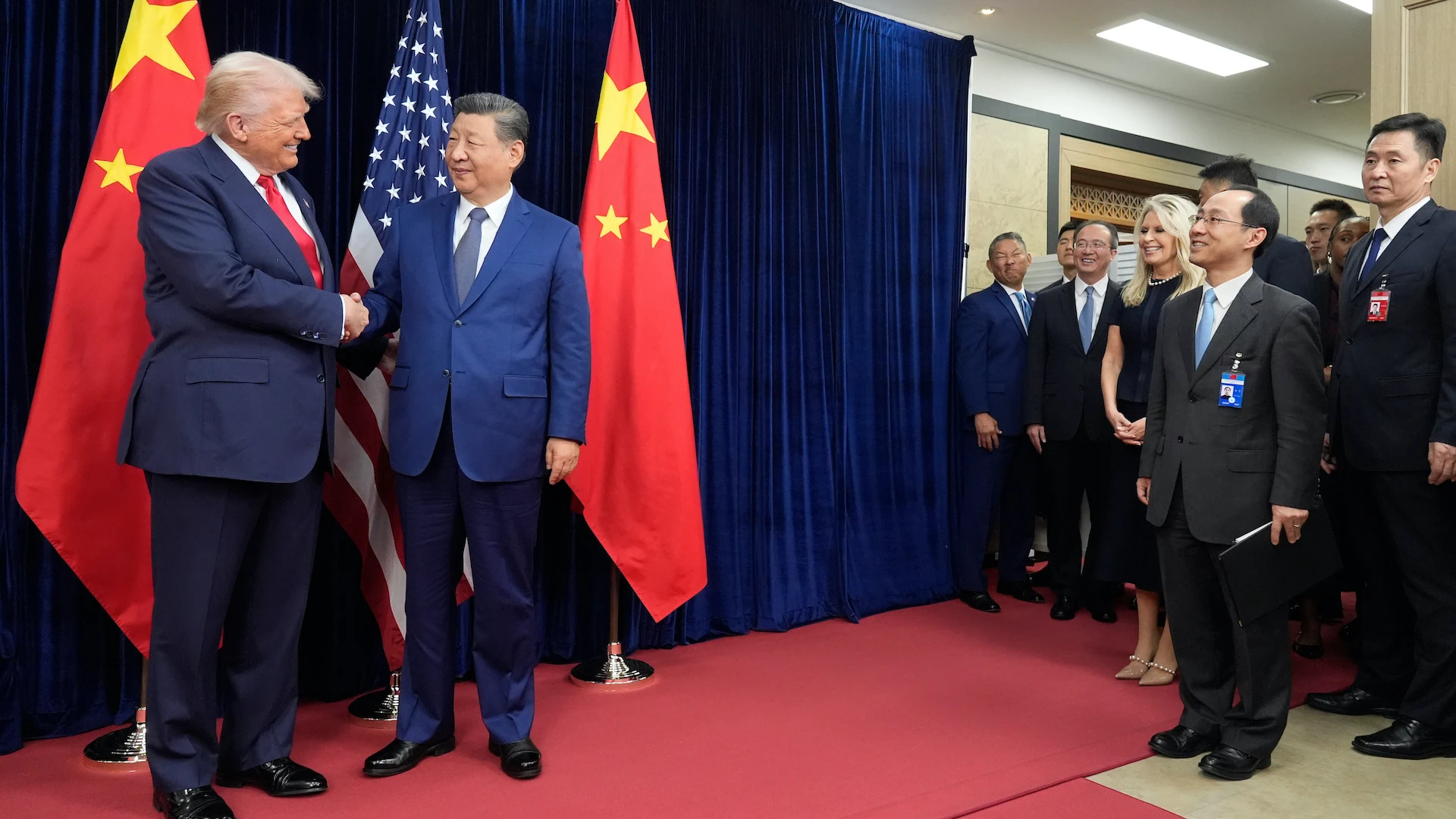

Speaking on CBS's Face the Nation, Bessent said the transaction would be formally endorsed by President Donald Trump and China's President Xi Jinping during a bilateral meeting in Korea later this week. "We reached a final deal on TikTok," Bessent said. "We reached it in Madrid, and I believe all the details are ironed out. It will be for the two leaders to consummate that transaction."

US politics

fromLondon Business News | Londonlovesbusiness.com

1 month agoNikkei 225 Index surpasses 50,000 - London Business News | Londonlovesbusiness.com

In my view, the easing of tensions between the United States and China has been the primary catalyst behind this surge, since markets have long considered the trade relationship between the world's two largest economies a direct threat to global trade flows and supply chains, especially when tariff rhetoric dominated the scene. The recent agreement between U.S. and Chinese negotiators on key issues gives markets a long-awaited breather and paves the way for a meeting between Trump and Xi that could cement these understandings.

World news

fromThe Atlantic

1 month agoChina Is Building the Future

The negotiations offer an occasion to stop to consider how China went from technological backwater to superpower in less than half a lifetime, and an opportunity for the United States to learn from that success. U.S. companies can work to regain hardware-manufacturing expertise, absorb knowledge and talent from some of China's best companies, and shift their approach toward AI, encouraging more practical applications and open-source innovation. The United States must accept that we can be better while not relinquishing our strengths.

World news

World news

fromLondon Business News | Londonlovesbusiness.com

1 month agoMarket analyst weighs in on Trump lowering tariffs - London Business News | Londonlovesbusiness.com

A brief Trump–Xi meeting yielded limited trade progress: a one-year rare-earths deal, resumed soy purchases, partial tariff cuts, but issues like Taiwan and TikTok deferred.

fromenglish.elpais.com

1 month agoTrump and Xi Jinping reach agreement on rare earths and tariffs in South Korea meeting

Trump assured that China has agreed to delay its restrictions on rare earth exports, one of the main points of conflict, for a period of one year, and announced an immediate reduction from 20% to 10% on the tariffs imposed in February on Chinese products due to Washington's claim Beijing is not doing enough to stop exports of fentanyl precursors.

World news

fromwww.aljazeera.com

1 month agoTrump says he will visit China early next year'

This is a breaking news story. United States President Donald Trump has said he will visit China early next year after receiving an invitation from Beijing. I've been invited to go to China, and I'll be doing that sometime fairly early next year. We have it sort of set, Trump told reporters at the White House on Monday. The US President also said he expected to seal a fair trade deal in South Korea with President Xi Jinping later this month

US politics

Information security

fromNextgov.com

1 month agoChina accuses NSA of multi-year hack targeting its national time systems

China accused the U.S. National Security Agency of a yearslong cyberespionage campaign against the National Time Service Center, exploiting an overseas phone provider and staff devices.

fromLondon Business News | Londonlovesbusiness.com

1 month agoDollar holds firm, trade developments in focus - London Business News | Londonlovesbusiness.com

The dollar index traded within a narrow range on Monday as easing US-China tensions provided support to the greenback. Market sentiment improved slightly after President Donald Trump signalled that broad tariffs on China would be unsustainable and negotiators from both sides confirmed plans for renewed talks in the coming days. Any progress this week could reinforce risk appetite and support the dollar, while setbacks could quickly reverse the tone.

US politics

World politics

fromwww.theguardian.com

1 month agoXi Jinping is preparing to go toe to toe with Donald Trump and there will only be one winner | Simon Tisdall

China is weaponising its near-monopoly on rare-earth minerals to exert geopolitical power, threatening Western military supply chains and global economic security.

Apple

fromYanko Design - Modern Industrial Design News

2 months agoApple Had 7 CEOs: Only 2 Really Mattered (And One Nearly Killed It) - Yanko Design

Tim Cook faces mounting departure speculation as he nears 65, pressured by US-China geopolitical tensions and the moral burden of balancing political and manufacturing obligations.

[ Load more ]