#christies

#christies

[ follow ]

#art-auction #art-market #auction-results #contemporary-art #20th-century-art #nfts #digital-art #sothebys

fromThe Art Newspaper - International art news and events

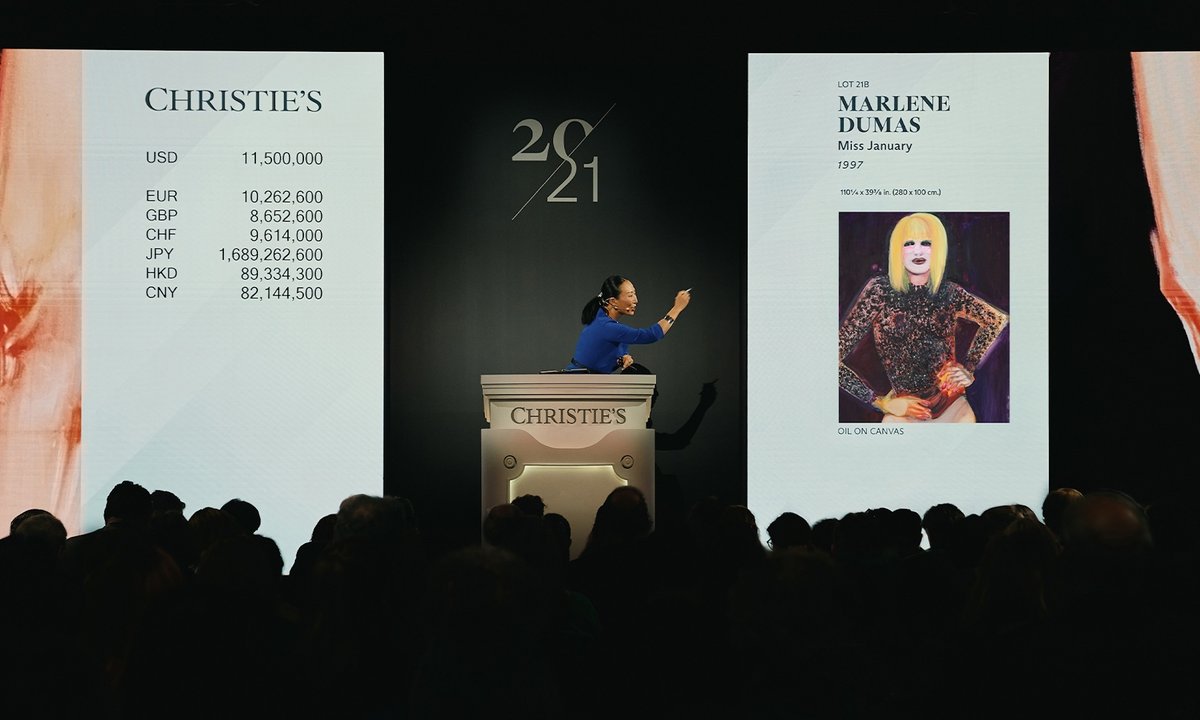

2 months agoArt market bounce back continues in New York with Christie's $123.5m 21st century sale

The art market's surprising recovery continued yesterday (19 November)at Rockefeller Centre, thanks to Christie's 21st century evening sale hauling in $99.5m, or $123.5m with fees. The result eclipsed last November's equivalent sale that realised $106.5m with fees. Last night's tally before fees fell midway between pre-sale expectations of $87m to $127m. Out of the 45 lots offered, just one-a Cecily Brown abstract-failed to sell, making for an almost-perfect buy-in rate of 98%.

Arts

fromHyperallergic

2 months agoThe Little Sargent Watercolor That Sold for $7M

Though last night's 20th Century Evening Sale at Christie's, the first of New York City's fall marquee week, was by all accounts a successful auction, there were not many surprises. It was not exactly shocking that the night's top lot, a desirable flame-colored Rothko from the Weis Collection, went for $62 million. Few eyebrows were raised when Matisse's "Figure et bouquet (Tete ocre)," already requested by MoMA for a show next year, climbed from $10 million to $13 million in seconds, eventually fetching three times that.

Arts

fromThe Art Newspaper - International art news and events

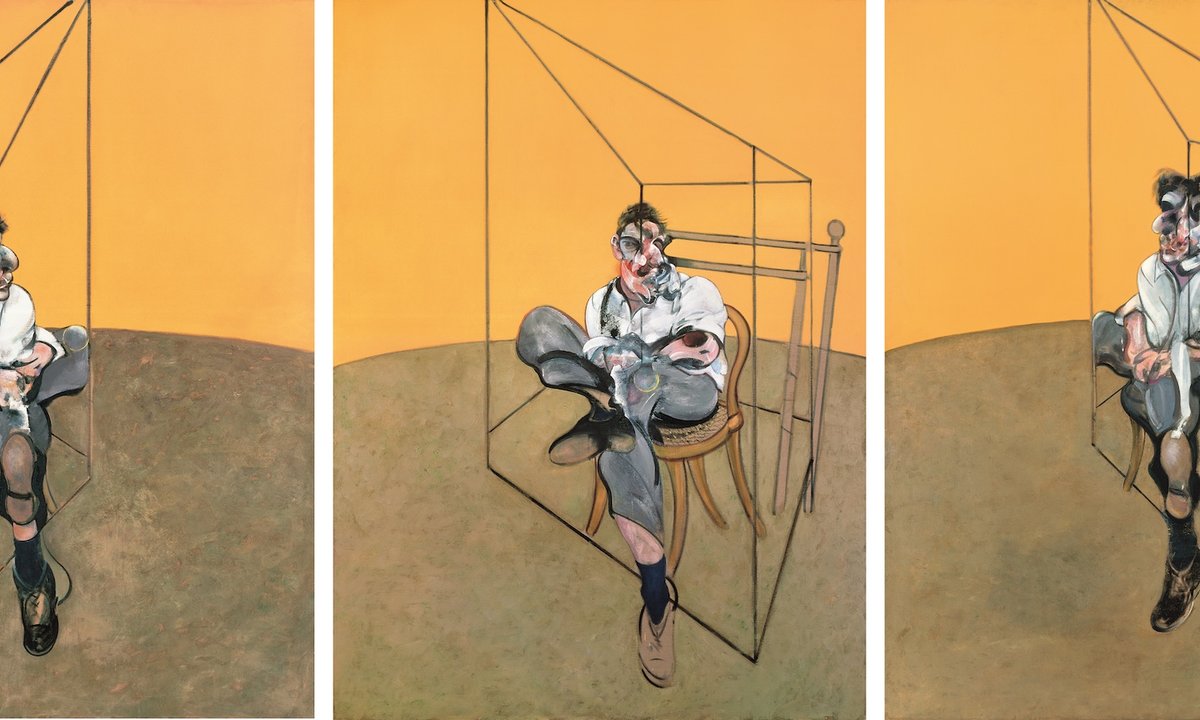

2 months agoKicking off New York November sales, Christie's nets healthy $690m from double-header 20th-century auction

Last night (17 November), Christie's kicked off New York's marquee November auctions with its 20th-century evening sale, plus top-notch offerings from a virtually unknown single-owner American collection. The auction house racked up $574.7m from both sales, which rises to $690m with fees. The result well surpassed last November's $485.9m total (with fees), indicating that the market is regaining confidence. It also lands squarely within its pre-sale estimate of $358m to $533m (all estimates calculated without fees).

Arts

Arts

fromARTnews.com

2 months agoAuction Houses Tapping into Jewelry Boom, Brooklyn Public Library Launches Art-Lending Program, Paris Photo Returns: Morning Links for November 14, 2025

Global auction houses are seeing rising demand and record results in the luxury jewellery market, with Christie's and rivals reporting strong sales and constrained supply.

fromESPN.com

2 months agoFamed Jim Irsay collection to be sold at auction

Our dad was a passionate collector, driven not by possession, but by a profound appreciation for the beauty, history and cultural resonance of the items he curated. From iconic instruments to handwritten lyrics by legends to rare historical artifacts and documents, each piece in the collection tells a story -- and he was always so excited to share those stories with the world.

Music

fromFast Company

3 months agoWhat can the rise and fall-and rebound-of NFTs teach us about the AI bubble?

On March 11, 2021, Christie's made history as the first major auction house to sell art in the form of a non-fungible token (NFT). Digital artist Beeple managed to offload his massive mosaic, Everydays: The First 5000 Days, for a whopping $69 million, generating hundreds of astonished headlines and getting those three letters, NFT, in front of untold scads of early-adopter eyeballs. It was the sale heard 'round the world, a starter pistol kicking off the NFT gold rush.

Digital life

fromThe Art Newspaper - International art news and events

4 months agoChristie's closes pioneering digital art department

In 2018, Christie's catapulted AI artwork into the mainstream when they sold the Paris-based collective Obvious's GANS inkprint Portrait of Le Comte de Belamy (2018) for $432,500, dwarfing the work's high estimate of $10,000. And, few could forget the March 2021 sale of Beeple's digital work Everyday: The First 5000 Days (2021), which hammered at $69.3m (the house applied no estimate) and put NFTs on the art world map.

Arts

fromThe Art Newspaper - International art news and events

6 months agoChristie's celebrates the late Syrian artist Marwan with non-selling London show

Judging by recent auction records that have been set by numerous artists from the Arab world and conversations with curators of major collections across the globe, it seems that demand for Arab art has expanded beyond the region into Western and Eastern collections.

Arts

[ Load more ]