#dividend-etfs

#dividend-etfs

[ follow ]

#income-investing #retirement-income #schd #passive-income #dividend-growth #vym #diversification #vanguard-vym #vig

from24/7 Wall St.

2 days agoThe 5 Safest Dividend ETFs for Boomer Retirement Income in 2026

The reason is simple: those who leave their careers to enjoy a well-deserved retirement lose the benefits of a regular salary and the benefits of their jobs, such as 401(k) matching and company-paid healthcare. In addition, many Baby Boomers take advantage of their retirement years to travel and enjoy the rewards they have worked hard to achieve throughout their lifetime. Choosing investments wisely is imperative, and at 24/7 Wall St., we constantly search for the best ideas for Baby Boomers and retirees.

Business

from24/7 Wall St.

5 days agoDo Not Retire Without Owning These 3 Dividend ETFs

If you are retiring or you're already retired and you have a portfolio that includes dividend ETFs, it's a good idea to make sure you have Schwab US Dividend Equity ETF (NYSEARCA:SCHD ) , Amplify CWP Enhanced Dividend Income ETF (NYSEARCA:DIVO ) , and iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT ) in your portfolio. These are some of the most well-balanced names that can help you squeeze the most out of what you have without taking on disproportionate risk.

Retirement

from24/7 Wall St.

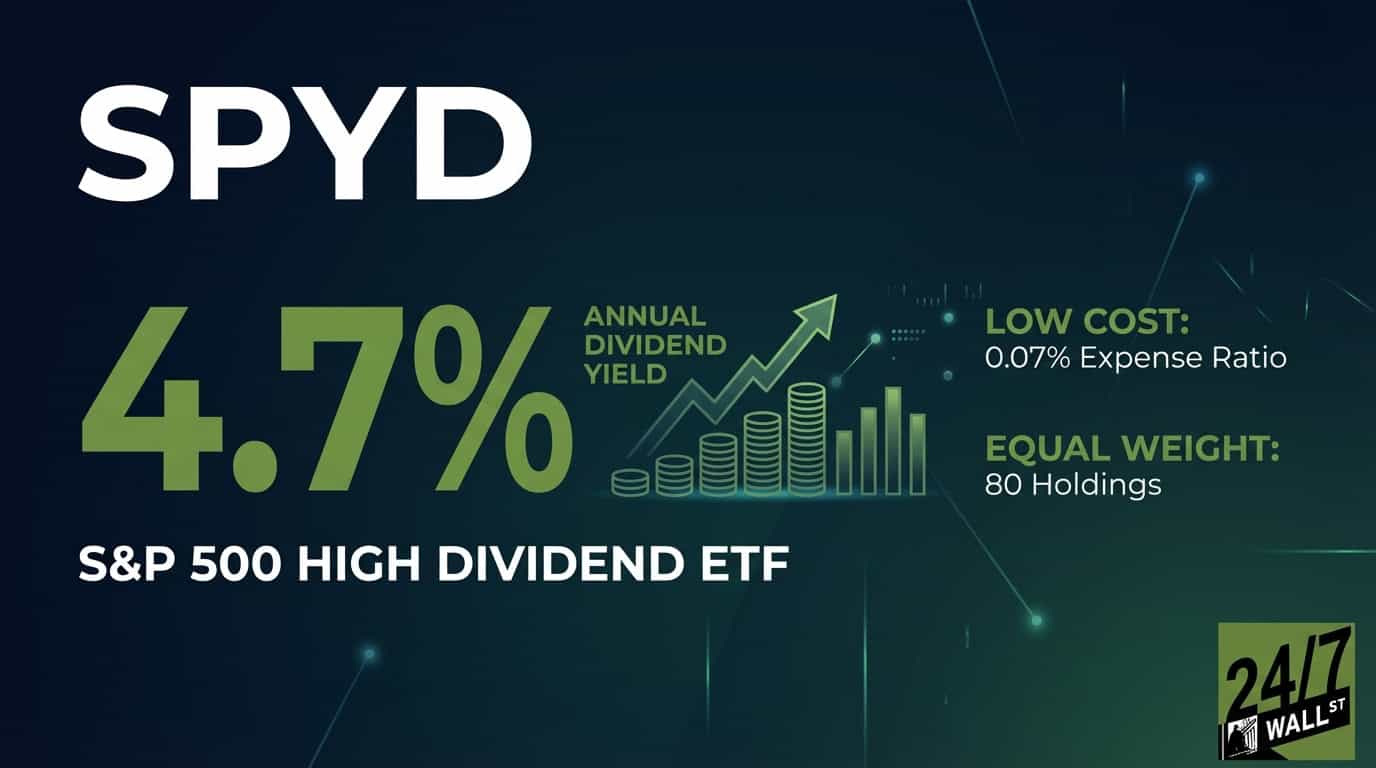

3 weeks agoSPDR's ETF Pays 4.5% And Is Perfectly Positioned Right Now

EDIV solves a specific portfolio problem: capturing dividend income from emerging markets without concentrated country or sector risk. The fund tracks the S&P Emerging Markets Dividend Opportunities Index, holding over 100 stocks across South Africa, Brazil, Taiwan, Malaysia, and the Middle East. No single holding exceeds 4% of assets. The return engine is straightforward. Companies generate cash and distribute it as dividends.

Business

from24/7 Wall St.

3 weeks agoUnder The Radar ETFs I like More Than Vanguard and Fidelity's Options

First on our list is the SPDR Russell 1000 Yield Focus ETF ( NYSEARCA: ONEY). The fund focuses on companies that have a high yield, low valuation, small size, and strong quality. ONEY aims to mimic the returns of the Russell 1000 Yield Focused Factor Index. It focuses on the dividend yield and takes a meandering approach to ensure a steady payout. It has a yield of 3.29% and pays quarterly dividends.

Business

from24/7 Wall St.

3 weeks agoThe 3 Dividend ETFs You Should Put In Your Stocking And Keep There for a Decade or Longer

There are plenty of dividend stocks out there for equity investors looking to maximize their overall total portfolio returns. Dividends can play a significant role in generating long-term returns, with around one-third of the cumulative returns of the stock market coming from dividends over the long-term. Now, this current market is dominated by high-growth stocks, many of which don't provide meaningful yields (if there are dividends paid out, many top tech companies have a yield well less than 1%).

Venture

from24/7 Wall St.

1 month ago3 Consistent Dividend Appreciation ETFs Investors Are Largely Ignoring, But They Shouldn't

Sure, there are some products that pay out increasing amounts over time (such as annuities and other structured products). But for investors holding more traditional portfolios consisting of a mix of stocks and bonds, the bond portion of one's portfolio is typically fixed or fluctuates alongside interest rate movements over time. In contrast, investing in dividend-paying stocks with a track record of raising their dividend distributions over time can provide passive income streams with inflation protection.

Business

from24/7 Wall St.

2 months agoWant $3,500 per Year in Monthly Passive Income? Invest Just $2,500 in These Generous Dividend Stocks

Listen up, dividend overachievers! With a mere $2,500 per stock or exchange traded fund (ETF), it's entirely possible to bring in $3,500 worth of passive income per year. To sweeten the deal, we can build out a master plan that will get you paid on a monthly basis and maybe even on a weekly basis. The trick is to look into the realm of real estate, where the stocks can pay surprisingly high yields.

Real estate

from24/7 Wall St.

2 months agoThe Hidden Dividend ETFs Paying Over 6% Without Extra Risk

Why These Funds Offer High Income Without High Anxiety The four ETFs below earn their yield from real cash flows, and not from financial wizardry or crazy math. On the plus side, they own a large number of companies that do well with generating steady income, such as REITs, energy infrastructure, banks, utilities, banks, and other dividend heavyweights. The big takeaway here is that diversification matters, and it's how you balance out risk with profit potential.

Business

from24/7 Wall St.

2 months agoHedge Funds Are Loading Up on These 3 ETFs

Hedge funds are always buying and selling stocks and exchange-traded funds (ETFs), and while it might not always be a great idea to replicate their moves, it doesn't hurt to keep a watch on what they're eyeing. Despite the recent volatility, hedge funds have made several buy and sell transactions in the third quarter, and they're loading up on , and Vanguard High Dividend Yield ETF (NYSEARCA:VYM).

Business

from24/7 Wall St.

3 months ago3 Dividend ETFs Outpacing the S&P 500

The S&P 500 is starting to pick up speed going into late-October after experiencing a bit of volatility on the back of the government shutdown, new Trump tariff threats, and a few early quarterly earnings fumbles. Despite the temporary setbacks, the dip-buyers have been more than willing to brave the dips, and that's made it tough to score anything more than a 2% or so dip from the S&P's all-time highs.

Business

[ Load more ]