#dividend-investing

#dividend-investing

[ follow ]

#passive-income #retirement-income #high-yield-stocks #reits #income-stocks #etfs #dividend-aristocrats

from24/7 Wall St.

1 month agoThe New Income Shift: Why Steady 4%Yields Are Outperforming High Flyers

If you stop and think about it briefly, a 4% yield doesn't seem all that impactful at a quick glance, but the reliability of such a number is where investors are hoping to win in 2026. Steady income definitely shifts the mindset from price-watching to income-building, which is a healthier and more sustainable approach to investing during volatile markets. You could even look at this 4% steady yield approach another way and think about how payouts will land in your bank account every quarter,

Business

from24/7 Wall St.

1 month agoWarren Buffett's 52% Portfolio Rests on These Three Dividend Giants

Based on the recent 13F filing, we've noticed Berkshire Hathaway Inc. ( NYSE: BRK-B) make significant moves in the third quarter. While the investor owns several artificial intelligence (AI) stocks, he also focuses on dividend-paying stocks. Apple ( NASDAQ:AAPL), American Express ( NYSE:AXP), and Bank of America ( NYSE: BAC) form 52% of his portfolio, and here's why I think they're an excellent buy.

Business

from24/7 Wall St.

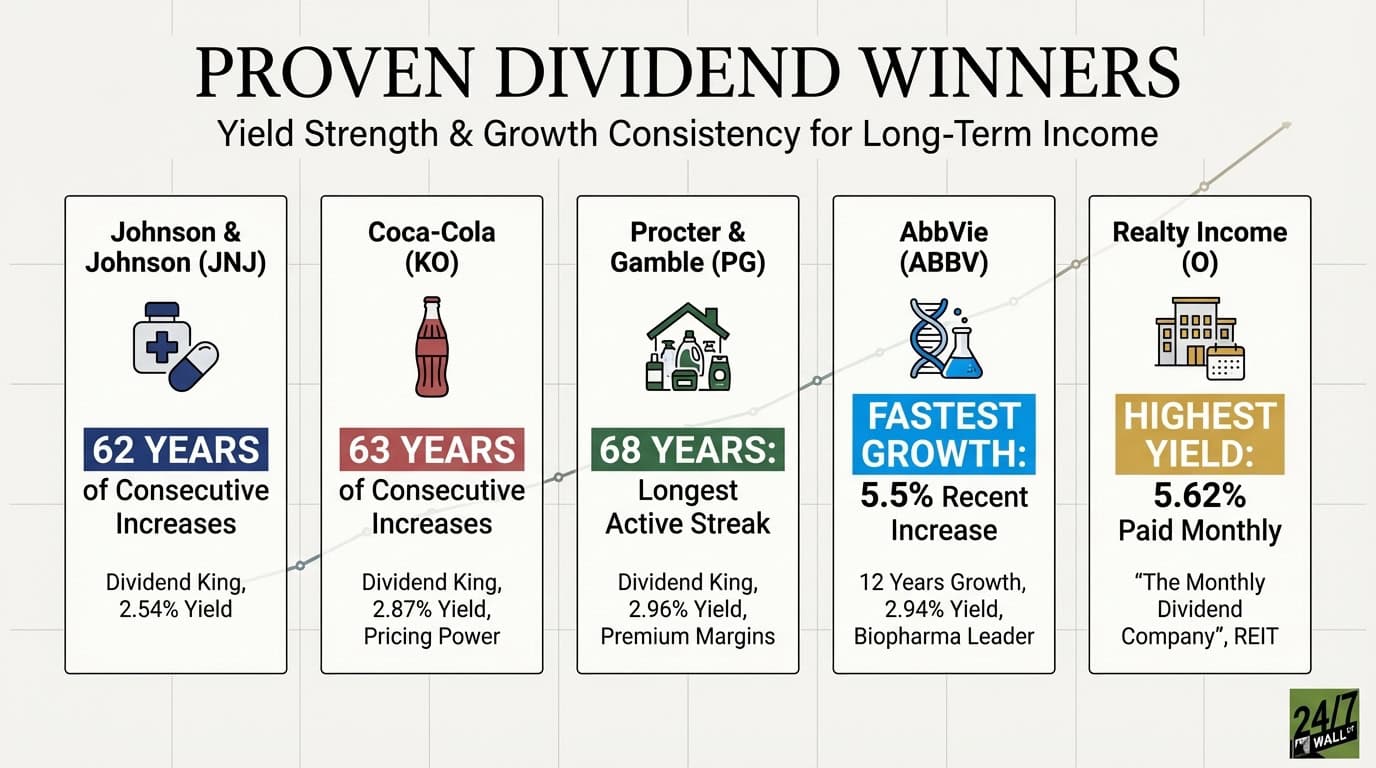

2 months ago5 Passive Income Monthly Pay Dividend All-Stars Every Boomer Should Own

Passive income is a steady stream of unearned income that doesn't require active traditional work. Shared ideas for earning passive income include investments such as dividend stocks, bonds, and mutual funds, as well as real estate and additional income-producing side hustles. According to the Internal Revenue Service (IRS), passive income generally includes earnings from rental activity or any trade, business, or investment in which the individual does not materially participate.

Business

from24/7 Wall St.

2 months agoWant $250,000 a Year in Dividends? Here's the Best Low-Risk Portfolio Mix for a $3 Million Nest Egg

If you have a $3 million nest egg to invest, a dividend-centered approach can be a great way to generate steady income. Even with a portfolio that size, it is important not to chase the highest yields you can find. With so many covered call and premium income ETFs offering 8 percent or even 10 percent yields, it can be tempting to forget the traditional 4 percent withdrawal rule. But maximizing yield often comes with hidden risks.

Business

Business

from24/7 Wall St.

3 months agoI have invested in dividends for 25 years-These high-yield picks have never let me down

Holding a small portfolio of high-quality, dividend-paying blue-chip stocks and reinvesting dividends can generate strong long-term passive income and substantial compounded returns.

from24/7 Wall St.

3 months ago5 Best Dividend Stocks in the S&P 500

Income investors rarely chase the loudest headlines. They look for companies that mail out checks, no matter what the talking heads predict for next quarter, and the S&P 500 is still the most convenient hunting ground for that kind of reliability. The index has been shifting more towards growth due to the mega-cap stocks doing extremely well over the past three years, and then being joined in by a new group of AI stocks that have ballooned into the top rankings.

Real estate

from24/7 Wall St.

3 months ago2 Stocks That Yield 12% and Higher Are Passive Income Kings

Dividend investing has long demonstrated its value, consistently outperforming broader market benchmarks over multiple decades. Studies from sources like Ned Davis Research show that dividend-paying stocks have delivered annualized returns around 9% since the 1970s, compared to just 4% for non-dividend payers, thanks to the compounding effect of regular payouts and lower volatility. While higher yields can amplify these advantages, providing a larger income stream to reinvest or spend,

Real estate

from24/7 Wall St.

3 months agoHow I Realized My Dividends Could Fund My Dream Trip - A Lesson in Financial Independence

One of the most important lessons in financial independence is to allocate your money in such a way that it continues to work for you. Pick investments that keep growing your money without you having to do anything. A Redditor recently shared that they funded a dream trip through dividends, and many were happy to learn about it.

Retirement

from24/7 Wall St.

3 months ago20 Years On Wall Street Taught Me: Buy and Hold High-Yield Dividend Giants

By analyzing cash flow generation, capital allocation strategies, and management quality, I can identify companies with durable competitive advantages and the financial discipline to maintain and grow their dividends through economic cycles. Early in my career, I realized that dividend investing is not merely an income strategy, but also a comprehensive framework for building wealth through companies that consistently return capital to shareholders while maintaining financial stability.

Business intelligence

[ Load more ]