#free-cash-flow

#free-cash-flow

[ follow ]

#capital-expenditures #dividend-sustainability #debt-risk #meta-platforms #aws #payout-ratio #leverage #dividends

from24/7 Wall St.

2 weeks agoDividend King Abbott Shows Why 52 Consecutive Increases Weren't Luck With Strong Cash Flow Coverage

The company just raised its quarterly dividend to $0.63 in January 2026, a 6.8% increase from the prior $0.59 rate. That puts the annual payout at $2.52 per share with a yield around 1.9%. Not eye-popping, but the safety and growth profile more than compensate. Abbott generated $6.35 billion in free cash flow in 2024 against $3.84 billion in dividend payments.

Medicine

from24/7 Wall St.

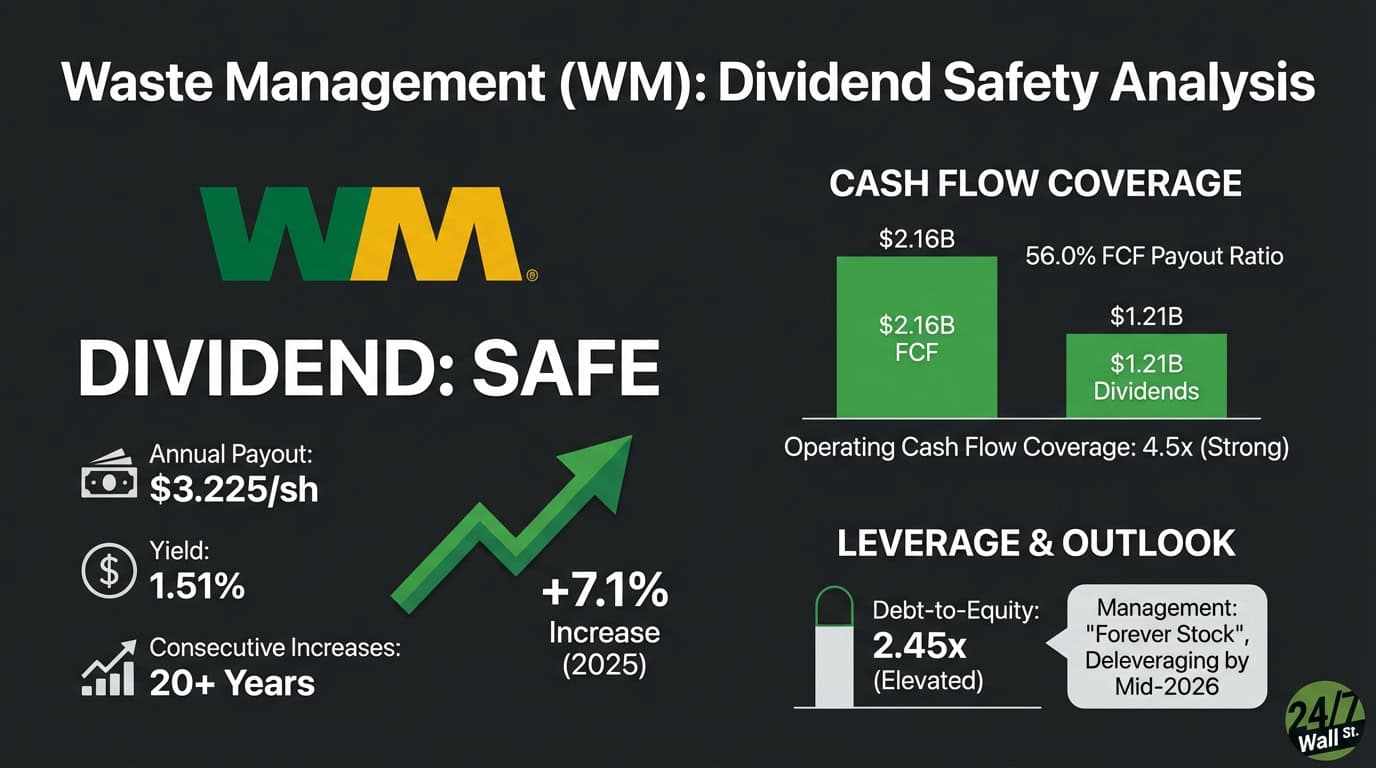

3 months agoWaste Management (WM) Stock Drops After Earnings

Waste Management ( NYSE: WM) missed on both earnings and revenue in Q3, posting adjusted EPS of $1.49 against expectations of $2.08 and revenue of $6.44B versus $6.70B estimated. The stock fell 2.35% in after-hours trading, though the decline was modest given the magnitude of the misses. The real pressure comes from guidance. Management now expects full-year revenue at the low end of its prior range, citing declining recycled commodity prices and softer healthcare solutions revenue.

Business

fromAol

3 months agoCloudflare (NET) Q3 2025 Earnings Call Transcript

Total Revenue -- $562 million, up 31% year over year for Q3 2025, with U.S. revenue comprising 58% (up 31%), EMEA at 27% (up 26% year over year), and APAC at 15% (up 43% year over year). Large Customers -- 4,009 customers spending over $100,000 annually as of Q3 2025, a 23% increase year over year, now contributing 73% of revenue, up from 67% in the third quarter last year.

Business

from24/7 Wall St.

3 months agoEarnings: Newmont (NEM) Beats Earnings, Shares Drop

Newmont ( NYSE: NEM) delivered a substantially stronger third quarter than Wall Street anticipated, with earnings per share of $1.71 beating consensus estimates of $1.44 by 19%, and revenue of $5.52 billion exceeding expectations of $5.27 billion by 4.7%.The gold producer's net income surged 95% year-over-year to $1.8 billion, driven by higher gold production and improved operational efficiency across its global portfolio.

Business

fromTESLARATI

3 months agoTesla's massive Q3 update reaffirms it's not just a car company anymore

16:25 CT - Good day to everyone, and welcome to another Tesla earnings call live blog. The Q3 2025 Update Letter seemed to be on the quieter side, but it's hard not to be impressed with Tesla's $4 billion free cash flow, an all-time high. Now we just have to see how the earnings call will go. 16:30 CT - Looks like the earnings call's livestream is up. It hasn't started yet, but the music's on. Here's the livestream:

Cars

from24/7 Wall St.

3 months agoLive Earnings: Complete IBM Q3 Coverage

IBM ( NYSE:IBM) heads into its third-quarter earnings tonight, up 30% year-to-date. After a stronger-than-expected second quarter-powered by software growth and robust mainframe refresh demand-attention now turns to where the company guidance for 2016 looks. Sentiment on whether AI-enabled software and Red Hat's hybrid-cloud momentum can drive another leg of margin expansion while free cash flow keeps pace with capital returns.

Tech industry

from24/7 Wall St.

3 months agoAre Investors Done With Palantir? Here's Where Is What's Next

Such valuations are almost unheard of when you discount smaller companies. In the same vein, expanding the earnings multiple from here is going to be an uphill battle. Palantir managed to fight its way upwards by posting one stellar earnings beat after another. In Q2 2024, it beat revenue estimates by 3.99%, with a 3.17% beat the next quarter, and a stellar 6.65% beat to finish off the year.

Business

from24/7 Wall St.

5 months agoFord's Dividend at Risk, According to Experts

Does Ford Motor Co. ( NYSE: F) have enough cash now and going forward to pay its rich dividend? There should be a great deal of skepticism accorded to a complex and detailed examination of Ford's financials. At risk is its current forward dividend yield of 5.22%, as provided by Yahoo. The figure is so high that it has become a primary reason to own the stock of the deeply troubled automaker.

Business

[ Load more ]