#investor-sentiment

#investor-sentiment

[ follow ]

#stock-market #tariffs #tesla #artificial-intelligence #earnings #nvidia #elon-musk #electric-vehicles

UK politics

fromLondon Business News | Londonlovesbusiness.com

1 week agoUK wage slowdown red flag for investors - London Business News | Londonlovesbusiness.com

Slowing wage growth alongside unchanged unemployment signals waning UK labour-market momentum and is likely to prompt investors to reassess Britain’s growth outlook.

from24/7 Wall St.

2 weeks ago5 Companies Racing to Dethrone Tesla-And the One Already Winning

Rivian Automotive ( NASDAQ:RIVN) delivered 42,247 vehicles in 2025, down 18% year over year, yet the stock surged 49% over the past 12 months. The company's $23.8 billion market cap reflects investor belief in its Amazon delivery van partnership, optimism around its upcoming R2, and adventure-focused consumer trucks. Third quarter revenue hit $1.56 billion, up 78% year over year, though the company still burns cash with a negative 3.1% gross margin.

Business

fromFortune

1 month agoThe bulls are too bullish: Bank of America warns 200-plus fund managers just triggered a contrarian 'sell' signal | Fortune

Bank of America's "Bull & Bear Indicator" rose from 7.9 to 8.5 in the last few days, triggering its contrarian "sell" signal for risk assets, according to a note from analyst Michael Hartnett and his colleagues seen by Fortune this morning. The indicator is derived from BofA's regular fund manager survey, which asks 200-plus investment managers about their appetite for risk. The logic of the Bull & Bear Indicator is that when everyone in the market is bullish, it's time to leave.

Business

Marketing tech

fromAdExchanger

2 months agoQ3: The Trade Desk Delivers On Financials, But Is Its Vision Fact Or Fantasy? | AdExchanger

The Trade Desk delivered solid Q3 revenue and profit growth but faces investor skepticism and must manage strained sell-side relationships as a dominant programmatic incumbent.

from24/7 Wall St.

2 months agoToast Inc. Q3 Earnings Miss on EPS, Beat on Revenue

Revenue reached $1.63 billion, beating the $1.59 billion consensus by 2.8% and climbing 25.1% year over year. Gross profit jumped 34.2% to $432 million, and the company added approximately 7,500 net new locations to reach 156,000 globally. Annual recurring revenue (ARR) surpassed $2.0 billion, up 30% from the prior year. The operational metrics paint a picture of a business firing on most cylinders.

Business

Miscellaneous

fromLondon Business News | Londonlovesbusiness.com

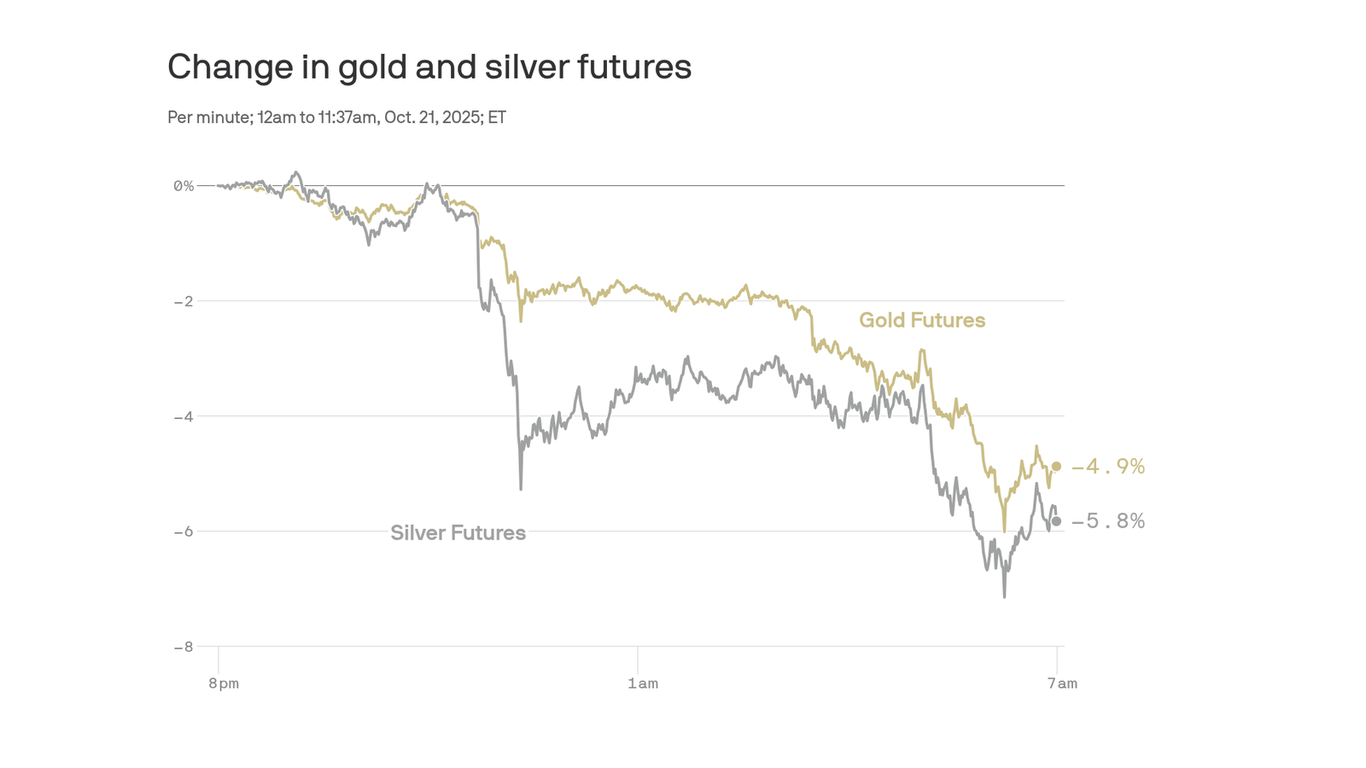

2 months agoUK gold investing hits 'crisis' level as number of first-time buyers tops the pandemic - London Business News | Londonlovesbusiness.com

UK investor and saver demand for gold has surged to crisis-level sentiment, driving record prices and a large increase in first-time precious-metal buyers.

fromBusiness Insider

2 months agoAI disappointment could roil markets and the economy, Liz Ann Sonders says

The AI boom is far more robust than the dot-com bubble, but there's still a risk it disappoints investors and sends shockwaves through markets and the economy, Liz Ann Sonders says. Charles Schwab's chief investment strategist told Business Insider that "extreme enthusiasm" about innovation and circular deals between tech companies reminded her of the internet bubble 25 years ago. But she said a key difference is that many dot-com companies were small and loss-making,

Business

Business

fromBusiness Insider

3 months agoHere's the chatter from hedge fund conferences run by Goldman Sachs, Morgan Stanley, Citi, and Kepler

Hedge-fund conferences in September revealed widespread allocator anxiety about market complacency and a potential pullback despite continuing US equity gains.

fromFortune

4 months agoU.S. stocks are chipping away at Europe's outperformance, and Powell slipped in this dovish signal on Fed rates that Wall Street overlooked | Fortune

U.S. stocks have made furious rebounds, setting fresh record highs and eroding the outperformance that European markets have enjoyed for much of this year. The S&P 500 is now up 13% year to date and the Nasdaq is up 17%. As recently as late June, when the broad market index had retaken its prior all-time high, both were up 5%.

Miscellaneous

fromTipRanks Financial

4 months agoi-mobile Co., Ltd. Reports Strong Financial Growth for Fiscal Year 2025 - TipRanks.com

i-mobile Co., Ltd. reported a significant increase in its financial performance for the fiscal year ending July 31, 2025, with net sales rising by 14.9% and profit attributable to owners of the parent increasing by 22.2%. The company's strong financial results reflect its effective strategies in the competitive digital marketing sector, indicating robust growth and a positive outlook for stakeholders.

Business

fromwww.theguardian.com

5 months agoEU-US trade deal hits investor confidence; Swiss stocks fall after tariff shock business live

Shares in lenders exposed to the UK car finance scandal surged at the start of trading in London, with Close Brothers jumping 27% following a favorable Supreme Court ruling.

UK news

US politics

fromLondon Business News | Londonlovesbusiness.com

6 months agoPositive outlook for the Dow Jones continues amid US Japan trade deal and earnings season - London Business News | Londonlovesbusiness.com

The Dow Jones Industrial Average rose 1.14% due to optimistic investor sentiment following a U.S.-Japan trade agreement.

fromLondon Business News | Londonlovesbusiness.com

6 months agoDAX climbs as auto sector rallies, but SAP declines - London Business News | Londonlovesbusiness.com

The DAX rose on Wednesday, led by a strong performance in the auto sector after a trade agreement between the United States and Japan lifted investor sentiment.

Germany news

fromLondon Business News | Londonlovesbusiness.com

6 months agoInvestor cautious as South Africa faces trade and industrial risks - London Business News | Londonlovesbusiness.com

The market remains fragmented. Gains in energy minerals and consumer non-durables were offset by declines in distribution services, non-energy minerals, and utilities.

Agriculture

fromLondon Business News | Londonlovesbusiness.com

6 months agoNigerian equities face investor caution near market peak, GDP figures could affect sentiment - London Business News | Londonlovesbusiness.com

The NGX All Share Index's approach to recent highs has led to potential profit-taking and a cautious sentiment among investors.

E-Commerce

[ Load more ]