#data-centers

#data-centers

[ follow ]

#ai-infrastructure #nvidia #energy-policy #electricity-prices #microsoft #artificial-intelligence #gpus

fromWIRED

10 hours agoData Centers Are Driving a US Gas Boom

Data centers have caused the demand for gas-fired power in the US to explode over the past two years, according to new research released Wednesday. More than a third of this new demand, the research found, is explicitly linked to gas projects that will power data centers -the equivalent of energy that would power tens of millions of US homes.

Environment

Artificial intelligence

fromTechRepublic

5 days agoPowerGen's Shock Pivot: How AI Data Centers Hijacked an Energy Conference

AI inference workloads are driving an unprecedented wave of multi‑billion dollar data center projects and stressing power and infrastructure capacity, concentrated in North America.

East Bay real estate

fromThe Mercury News

2 days agoPlanning Commission backs industrial project in Oakley despite fears over data centers

The Oakley Planning Commission approved the Bridgehead Industrial project, requiring a conditional use permit for any data centers while allowing diverse industrial uses on 164 acres.

East Bay real estate

fromwww.mercurynews.com

2 days agoPlanning Commission backs industrial project in Oakley despite fears over data centers

Oakley planning commission approved a large industrial development plan with data centers allowed only via conditional use permits amid environmental and infrastructure concerns.

fromAol

5 days agoIs OpenAI's Decision to Begin Selling Ads on ChatGPT a Desperate Cry for Help?

In 2024, OpenAI's CEO, Sam Altman, called ads a "last resort" for businesses. Well, the parent company of ChatGPT appears to have hit this point in less than two years. OpenAI made big news recently when it announced plans to start testing ads on U.S. users of its free and low-cost subscription accounts. The ads will be clearly labeled, and OpenAI also said it does not plan to sell user conversations to companies or let advertisements drive conversations.

Artificial intelligence

fromBusiness Insider

6 days agoOracle and OpenAI's data center buildout requires billions in debt - and Wall Street is eyeing it carefully

But the massive initiative, called Stargate, may be exhausting the supply of available capital. JPMorgan Chase, the bank that recently led a pack of lenders to extend roughly $38 billion of debt for the construction of two planned Stargate data center campuses in Texas and Wisconsin, has encountered diminished interest as it has sold off pieces of the loan to other financial players, a person familiar with the situation said.

Business

Tech industry

fromFortune

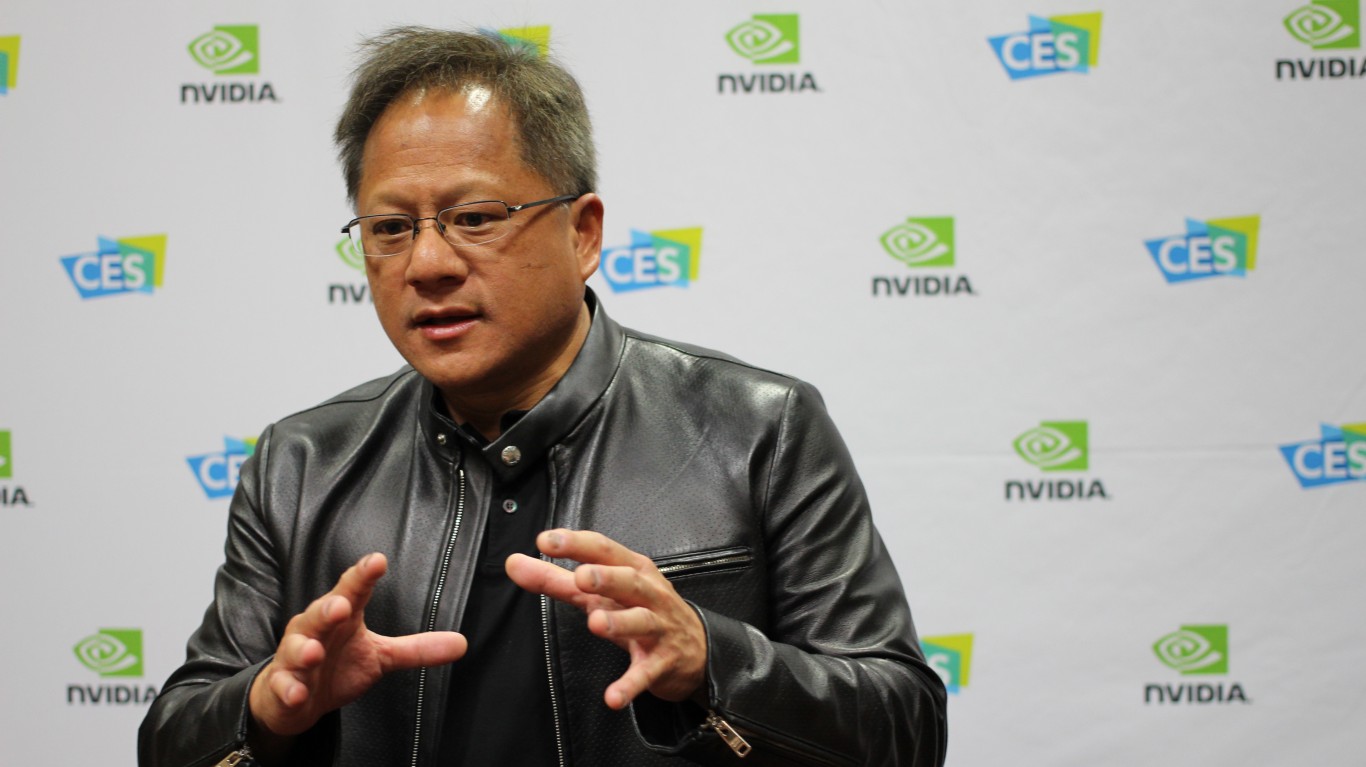

1 week agoSix-figure plumbing and construction jobs are coming, Nvidia CEO Jensen Huang says-as AI data centers need to be built | Fortune

Rapid global data-center and AI infrastructure buildouts will create many high-paying skilled-trade jobs, such as electricians, plumbers, construction workers, and supervisors.

Artificial intelligence

from24/7 Wall St.

1 week ago2026's Biggest AI Trends: The Rise of AI Factories | VRT Stock, NVT Stock, MOD Stock

AI factories are gigawatt-scale data centers manufacturing intelligence at industrial scale, driving explosive demand for electricity, construction, networking, and advanced liquid cooling.

fromThe Motley Fool

1 week ago3 No-Brainer AI Stocks to Buy Hand Over Fist for 2026 | The Motley Fool

At the CES 2026 show recently, management reiterated that demand for its Blackwell platform remains robust, even as its next-generation Vera Rubin systems are expected to roll out in the second half of 2026. Management said last quarter that Blackwell and Rubin are together supporting revenue visibility of roughly $500 billion through 2026. Of this, $150 billion in orders had already been shipped through the third quarter of fiscal 2026 (ending Oct. 26, 2025).

Artificial intelligence

Environment

fromEarth911

1 week agoSustainability In Your Ear: Peter Fusaro's Wall Street Green Summit Explores Financing The Renewables Transition

Energy transition faces infrastructure bottlenecks, rising grid stress from data centers, yet capital markets and institutions increasingly treat climate as systemic financial opportunity.

fromFortune

1 week agoFord CEO warns there's a dearth of blue-collar workers able to construct AI data centers and operate factories: 'Nothing to backfill the ambition' | Fortune

With AI predicted to balloon to a $4.8 trillion market by 2033, Farley warned the U.S. has overlooked the labor needed to build and sustain data centers and manufacturing facilities. While President Donald Trump imposed sweeping tariffs to revive factory jobs, there continues to be recruitment and retention problems in U.S. manufacturing.

Artificial intelligence

fromFast Company

1 week agoThis old Pennsylvania coal town could get a reboot from AI

For decades, he's lived in Homer City, a southwestern Pennsylvania town that was once home to the largest coal-fired power plant in the state. The plant, which shares its name with the town, closed nearly three years ago after years of financial distress. Dudash, 89, has lived in the shadow of its smokestacks-said to be the tallest in the country before they were demolished-for much of his life.

Environment

Artificial intelligence

fromComputerworld

2 weeks agoGartner: worldwide semiconductor revenue totaled $793 billion in 2025

Global semiconductor sales reached $793 billion in 2025, a 21% year‑over‑year increase driven largely by demand for AI chips, GPUs, and data center growth with Nvidia leading sales.

US politics

fromBusiness Insider

2 weeks agoTrump says that Microsoft will 'ensure' Americans don't 'pick up the tab' for its data center power consumption

President Trump urged tech companies to pay for their data-center power consumption to prevent higher utility bills for Americans, naming Microsoft as first to comply.

California

fromLos Angeles Times

2 weeks agoWhy California is keeping this unusual solar plant running when both Trump and Biden wanted it closed

California ordered the Ivanpah solar-thermal plant to remain open 13 years despite costs, obsolescence, and bird deaths, citing grid reliability amid rising data-center demand.

fromTechzine Global

3 weeks agoAnthropic aims to raise $10B with a valuation of $350B

Anthropic appears to be preparing for one of the largest financing rounds ever in the AI sector. The developer of the Claude chatbot is in talks with investors about a capital injection of approximately $10 billion, which would value the company at around $350 billion. This would mean another sharp rise in valuation in a short period of time. According to reports in The Wall Street Journal, investor Coatue Management and Singapore's sovereign wealth fund GIC are leading this round.

Venture

fromChannelPro

3 weeks agoVirtus Data Centres eyes further expansion under new CEO

Virtus Data Centres has announced the appointment of industry veteran Adam Eaton as its new chief executive officer, effective immediately. The move paves the way for the pure play data center owner-operator - part of ST Telemedia Global Data Centres (STT GDC) - to continue expanding its portfolio of data centers across the UK and Europe. A seasoned industry leader, Eaton brings a combination of commercial and operational expertise

Business

Real estate

fromFortune

3 weeks agoAngry town halls nationwide find a new villain: the data center driving up your electricity bill while fueling job-killing AI | Fortune

Communities increasingly block large, resource-intensive data center projects due to concerns about water, energy, zoning, and local impacts.

fromTechzine Global

3 weeks agoHow much energy do Microsoft and Google consume? The Dutch don't know

The new European Energy Efficiency Directive (EED) requires large companies to report their energy and water consumption annually from 2024 onwards. Data centers with at least 500 kW of installed IT capacity must report to national authorities such as the RVO by May 15 at the latest. However, compliance appears to be problematic: of the 160 Dutch data centers, 104 submitted something, but 27 left crucial fields blank. All but three of these were American-owned.

Miscellaneous

from24/7 Wall St.

3 weeks agoTariffs Pushed CPER Up 39%, Doubling S&P 500 Returns

While investors chased artificial intelligence stocks and cryptocurrency throughout 2025, a commodity fund quietly delivered returns that rivaled the market's biggest winners. The United States Commodity Index Funds Trust ( NYSE:CPER) surged 39% last year, matching NVDA's performance and more than doubling the S&P 500's 16% gain. CPER tracks copper futures contracts, providing exposure to the industrial metal without mining company operational risks.

Business

Environment

fromTruthout

4 weeks agoAs Towns and Cities Fight Off Data Centers, Calls Grow for a National Moratorium

Communities nationwide are organizing to stop hyperscale data-center expansion and associated fossil-fuel infrastructure, demanding moratoriums to prevent environmental, water, and public-cost burdens.

fromTechCrunch

4 weeks agoExclusive: 12 investors dish on what 2026 will bring for climate tech | TechCrunch

They are creating their own financial ecosystem, and there is enough actual momentum in current AI efforts that I don't see the hyperscalers pulling back in 2026, Tom Chi, founding partner at At One Ventures, told TechCrunch.

Environment

fromBusiness Insider

1 month agoSoftBank is buying DigitalBridge for $4 billion to accelerate its AI ambitions

SoftBank said it will acquire digital infrastructure investor DigitalBridge for about $4 billion. The Japanese conglomerate said it is doubling down on building the data centers, connectivity, and power needed to support AI at a global scale. "As AI transforms industries worldwide, we need more compute, connectivity, power, and scalable infrastructure," said Masayoshi Son, chairman and CEO of SoftBank Group. The deal underscores SoftBank's push to control more of the physical infrastructure behind AI as competition for computing resources intensifies.

Tech industry

fromTechCrunch

1 month agoMayimFlow wants to stop data center leaks before they happen | TechCrunch

MayimFlow, the Built World stage winner at this year's TechCrunch Disrupt, is a good example. The startup is focused on essentially one task: preventing damaging water leaks. Data centers use a lot of water, and that water can present a big risk, even if a leak is small. Founder John Khazraee told TechCrunch that many data centers only have reactive solutions for water leaks. That can saddle companies with downtime and set them back millions of dollars if one occurs.

Startup companies

fromThe Verge

1 month agoTrump's war on offshore wind faces another lawsuit

The complaint Dominion filed Tuesday alleges that a stop work order that the Bureau of Ocean Energy Management (BOEM) issued Monday is unlawful, "arbitrary and capricious," and "infringes upon constitutional principles that limit actions by the Executive Branch." Dominion wants a federal court to prevent BOEM from enforcing the stop work order. "Virginia needs every electron we can get as our demand for electricity doubles."

Environment

from24/7 Wall St.

1 month agoLukewarm AI Plays Can Catch Up in 2026

Undoubtedly, there's still a lot of nerves out there over the latest wave of volatility, which may very well be the start of a painful, drawn-out move lower. As to whether we're in an AI bubble, though, remains a mystery. It'll probably be the big question going into the new year. With a recent wave of relief powering hard-hit AI stocks higher in the last few sessions, it seems like AI fears might be in an even bigger bubble than the AI stocks themselves.

Artificial intelligence

[ Load more ]