#jobs-report

#jobs-report

[ follow ]

#federal-reserve #bureau-of-labor-statistics #government-shutdown #labor-market #interest-rates #economy

US politics

fromwww.theguardian.com

1 month agoSusie Wiles interview might be a useful distraction from how poorly things are going for Americans

Susie Wiles described multiple Trump administration figures as extreme or unfit while economic data show job losses, rising unemployment, and growing political vulnerability.

fromFortune

2 months agoThe exit economy is here. Black Women are paying the highest price | Fortune

Black women are being sidelined at scale Since February, Black women have lost 297,000 jobs. Another 223,000 remain unemployed. And 75,000 have been pushed out of the labor force entirely. I estimate that these forced exits alone are draining an estimated $9.2 billion from U.S. GDP this year. These aren't just missing paychecks; they represent lost productivity, lost tax revenue, and diminished national output.

Social justice

fromwww.mercurynews.com

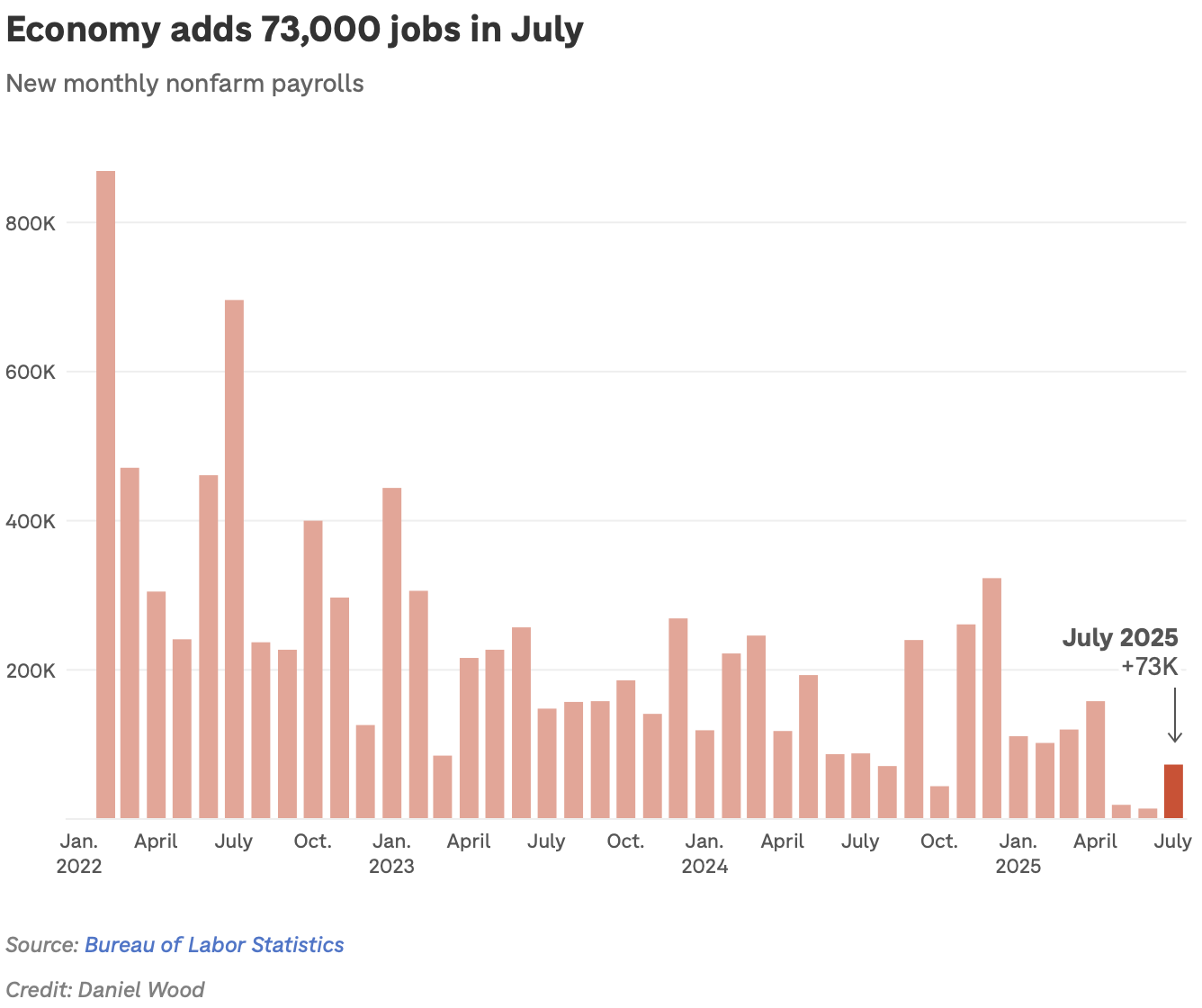

2 months agoUS employers add a surprising 119,000 jobs in September according to data delayed for weeks

WASHINGTON (AP) U.S. employers added a surprisingly solid 119,000 jobs in September, the government said, issuing a key economic report that had been delayed for seven weeks by the federal government shutdown. The increase in payrolls was more than double the 50,000 economists had forecast. Yet there were some troubling details in the delayed report. Labor Department revisions showed that the economy lost 4,000 jobs in August instead of gaining 22,000 as originally reported.

US news

Business

from24/7 Wall St.

2 months agoHere Are Thursday's Top Wall Street Analysts Research Calls: Amazon.com, Biogen, Caterpillar, e.l.f. Beauty, Southern Company and More

Markets rebounded after a sell-off as jobs growth, positive earnings, and easing AI bubble concerns supported stocks while bond yields and oil and gas shifted.

fromFortune

4 months agoMortgage rates plunge to 11-month low on Fed rate cut hopes, and many lenders may quote in the high 5% range

Bond yields tumbled as the weaker-than-expected jobs report raised expectations for rate cuts from the Federal Reserve. That sent the average rate on the 30-year fixed mortgage to the lowest level since October 2024. The steep drop could help shake up the housing market, which has seen a dearth of activity amid high home prices and borrowing costs. After a disappointing spring and summer, the housing market could start to heat up as fall approaches with the latest plunge in mortgage rates.

Business

fromwww.mediaite.com

7 months agoFox's Maria Bartiromo Hypes Good Job Numbers About to Come In And Skips Right By Them As News Turns Negative

The June job report revealed a decline in the private sector with a loss of 33,000 jobs, contrasting sharply with the anticipated growth of nearly 100,000 jobs.

US politics

[ Load more ]