#connected-tv

#connected-tv

[ follow ]

#programmatic-advertising #advertising #the-trade-desk #ctv-advertising #amazon-ads #adtech #amazon #youtube

fromBusiness Insider

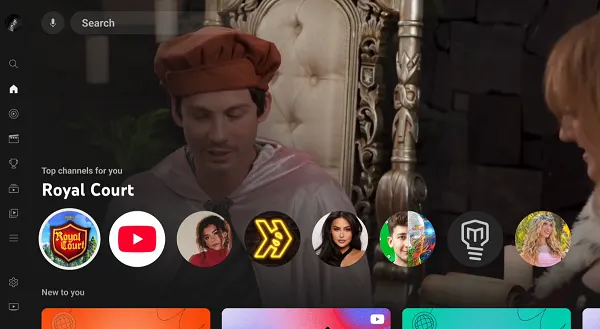

1 week agoThe line between TV ads and YouTube ads is getting very blurry

Google has been coveting lucrative TV ad budgets for more than a decade. But despite stats showing that an increasing amount of YouTube viewing takes place on TV sets in the living room, its ad sellers faced a hurdle. Many advertisers and agencies classified YouTube as "online video" or "social media," treating it as a separate part of the media plan from TV.

Marketing

Marketing tech

fromExchangewire

1 week agoCovatic Sense: New Solution Unlocks Individual Addressability & Attribution for Connected TV

Covatic Sense provides privacy-first, person-level CTV targeting and measurement by passively detecting in-room mobile devices and sending only anonymous audience cohort codes.

Media industry

fromVariety

3 weeks agoAsia-Pacific Video Revenue to Reach $196 Billion by 2030, With India Overtaking China in SVOD Subscriptions, Report Forecasts

Streaming services, social video platforms, and connected TV will drive all Asia-Pacific screen revenue growth to 2030 while traditional television revenues decline.

fromMarTech

1 month agoIAB Tech Lab introduces new CTV ad formats, updates programmatic guidance | MarTech

These were distilled from over 100 real-world submissions gathered through the industry-wide "Ad Format Hero" initiative. Dig deeper: 4 questions every SMB should ask before testing CTV IAB Tech Lab has also updated its programmatic CTV guidance, offering practical advice on how to transact these ad types more efficiently. The update includes enhanced OpenRTB support, with a focus on the two formats prioritized by an industry working group: Pause and Menu.

Marketing tech

fromExchangewire

1 month agoMedia Experts in Australia Prioritise CTV, Retail Media, & Social Media Influence as AI Reshapes 2026 Strategies

"2026 will be a defining year for Australia's digital ecosystem," said Jessica Miles, country manager ANZ at IAS. "As AI accelerates the creation of content at unprecedented speed, brands are demanding sharper attention insights, stronger transparency, measurement, and optimisation that can keep pace with the complexity of emerging media. The next year will reward marketers who embrace innovation, and who invest not just in reach, but in the quality and integrity of every impression."

Marketing tech

fromForbes

2 months ago20 Sectors Set To Ignite New Agency Opportunities

As new technologies like generative AI reshape markets, and client needs evolve along with them, agencies are looking beyond traditional sectors to new avenues of growth. From healthcare innovations to the rise of connected media and sustainable consumer brands, fresh opportunities are emerging across every industry. Agencies that thrive will identify where inevitable change intersects with unmet need and position themselves as strategic partners, helping clients tap novel revenue sources.

Marketing

fromTipRanks Financial

2 months agoMNTN, Inc. Reports Strong Q3 2025 Results - TipRanks.com

MNTN, Inc., a leading technology platform in the Connected TV advertising sector, is revolutionizing how brands approach television advertising by making it as measurable and performance-driven as digital marketing. The company reported a strong third quarter for 2025, with revenue increasing by 31% year-over-year to $70 million, and a significant improvement in gross margin to 79%. MNTN also achieved a positive net income of $6.4 million, a notable turnaround from a net loss in the previous year.

Marketing tech

Marketing

fromModern Retail

2 months agoBest Buy teams up with influencers and YouTubers for holiday campaigns, including 'Hot Ones' and 'Binging with Babish'

Best Buy is expanding influencer-focused holiday marketing across connected TV, YouTube sponsorships, and creator partnerships to reach consumers where they engage.

fromAdExchanger

2 months agoHow Agentic Advertising Platform Aimy Uses Comcast's Universal Ads API | AdExchanger

When Comcast released its self-serve Universal Ads platform earlier this year, it included an ads API with the goal of making CTV ads accessible to small businesses, just like search and social media ad buying. Now, other ad tech developers are incorporating the API into their products and workflow. Like Brand Networks, which on Monday announced that Universal Ads would now be buyable through the company's agentic ad buying platform, Aimy Ads.

Marketing tech

fromwww.cnbc.com

3 months agoTop picks from the Sohn conference include digital mortgage and advertising stocks

Magnite is the largest independent platform that helps companies such as Netflix and Disney monetize their advertising. The company, formed following a merger between Rubicon Project and Telaria in 2020, is benefiting from the changed landscape in the entertainment industry as bandwidth increased, content owners created on-demand libraries and ad technology evolved, Edwards said. "Connected television is the growth driver of the business, and it's about 44% of revenues. And this is basically the TV on your wall, which you stream content through," he said.

Marketing tech

fromExchangewire

3 months agoPixalate's September 2025 Top Grossing Global Mobile Apps: 'Happy Color' No. 1 on the United Kingdom Google Play Store - ExchangeWire.com

Wordscapes led US Apple App Store open programmatic ad revenue in September 2025 with an estimated $5M; Pocket FM led Google Play with $3M.

fromDigiday

3 months agoCTV beyond the living room: The marketer's guide to expanding CTV to every screen

Earlier this year, Nielsen reported that, for the first time, more people watch TV via streaming services than both broadcast and cable combined. According to "The Gauge" report, streaming accounted for 44.8% of TV viewership as of May 2025, while broadcast and cable together accounted for 44.2%. And as live sports increasingly become part of the streaming landscape, streaming viewership is not expected to slow down.

Marketing tech

fromPackaging Dive

3 months agoSonoco's inaugural TV ads put a lens on packaging's everyday moments

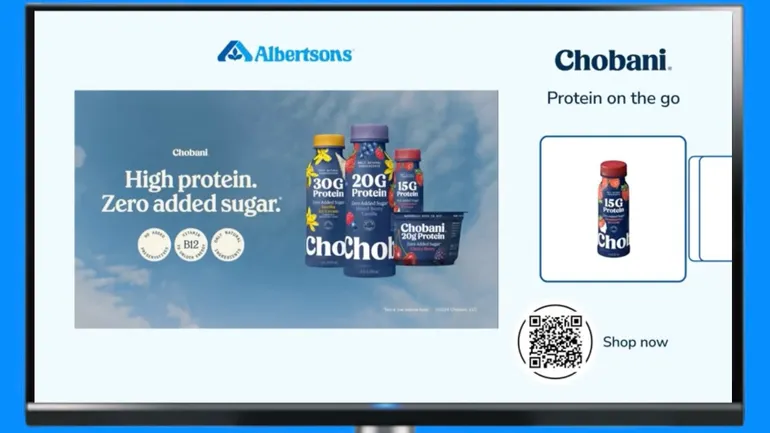

Listen to the article 6 min this year It's based on connected TV, or CTV, referring to ads that are delivered through internet-connected televisions and streaming services. CTV tools allow the company to hone its messaging to a particular audience: those in certain regions, ZIP codes, or even to individual viewers, Skipper said. The company's goal was to use that knowledge to engage with and boost Sonoco's name recognition among key niche audiences, such as private label customers.

Marketing tech

Marketing tech

fromExchangewire

3 months agoPixalate's August 2025 United States Publisher Rankings for Websites, Mobile & CTV Apps - ExchangeWire.com

Pixalate released the August 2025 Publisher Trust Index ranking websites, mobile apps, and CTV apps to measure ad quality, fraud, and transparency globally.

fromAdExchanger

4 months agoStop Paying For The Same Eyeballs Twice: How Smarter CTV Planning Unlocks True Reach | AdExchanger

Connected TV ensures more targeted advertising. But, while streaming, many viewers end up seeing the same ad multiple times. Since viewers split their time between linear and countless streaming platforms, marketers are left piecing together siloed partner reports and guessing which households were truly exposed to their campaigns. Without the right partners and solutions, even the most carefully planned campaigns can fall short.

Marketing tech

fromForbes

4 months agoThe Future Of Connected TV Is Already Here-What Happens Next?

Vibhor Kapoor is the Chief Business Officer at , an AI-powered advertising technology company. With the average consumer requiring 56 branded touchpoints before making a purchase, connected TV (CTV) has emerged as one of the most effective ways to bridge those touchpoints across channels. Once considered a top-of-funnel tool for building brand awareness, CTV has quickly evolved into a high-performing, full-funnel channel with better targeting, measurement and retargeting capabilities.

Marketing tech

from24/7 Wall St.

4 months agoThis Hot Stock Is Up 425% and Got Added to the S&P 500 Today. Still Time to Buy?

Gaming and mobile app advertising company AppLovin ( ) has been a rocket ride for investors, as its stock surged 425% over the past year. Fueled by the 2023 launch of its Axon 2.0 engine for hyper-targeted ad placements, ad efficiency increased and delivered 74% year-over-year revenue growth to $2.4 billion for the first six months of 2025. Adjusted EBITDA margins also hit an eye-popping 81%, due to e-commerce expansions and an international push into high-intent markets.

Marketing tech

fromThe Drum

4 months ago'Alexa, open the new Autumn collection': why voice tech is the new frontier in shoppable TV

Connected TV is booming, with breakneck growth driving a new kind of ad experience. It's not just about reach - 75% of UK households now own a smart TV - it's also creating scope for richer interactivity and more engaging entertainment. In an ad market set to double by 2028, brands have a chance to capitalize on a new set of consumer viewing habits.

Marketing tech

fromThe Drum

4 months agoTurn on the audience: 4 plays for better CTV experiences

TV is no longer passive. With connected TV (CTV), streaming platforms, and shoppable formats, the medium has become both more complex and more creatively fertile. What was once one-way communication is now a two-way relationship where audiences consume, interact, evaluate, and even purchase in real time. Understanding the audience behind the screen Linear TV campaigns were predictable and measured by reach.

Marketing

Marketing tech

fromExchangewire

4 months agoKargo & Contagion Launch First CTV Tiles Campaign with PlaceMakers in APAC

Kargo's Tiles converts vertical social videos into low-cost, brand-safe CTV ads, enabling smaller and mid-sized brands to access premium television-scale advertising with strong completion rates.

Marketing tech

fromBusiness Insider

4 months agoNetflix is teaming up with Amazon, and it's dragging down adtech rival The Trade Desk's stock

Netflix will permit advertisers to buy ads via Amazon DSP starting Q4, escalating competition and contributing to significant declines in The Trade Desk's stock.

fromTech Times

4 months agoGoogle Admits Open Web is Declining Despite Claims of a Thriving Search Ecosystem

But last week, Google contradicted this stance in a court filing. The tech giant acknowledged that "the open web is already in rapid decline." In a pre-trial filing, Google reacted to the US Department of Justice's suggestion to sell off its advertising division. Google maintained that it would only hasten the downfall of the open web, an environment that a majority of publishers depend on for display advertising revenue.

Online marketing

fromSocial Media Today

4 months agoYouTube Sets Live-Stream Viewing Record with NFL Opening Night

and with Connected TV viewing (i.e. people watching YouTube content on their home TV sets) continuing to grow, it's legitimately a competitor for traditional TV channels in many respects. And with YouTube's more advanced ad targeting tools and options, that could make it an increasingly valuable consideration for your campaigns, enabling broad reach to sports fans, with hyper-targeted, even AI-facilitated targeting to maximize reach and resonance.

Marketing tech

Marketing tech

fromExchangewire

5 months agoFreeWheel Partners with Experian to Offer Advanced Targeting Capabilities & Extended Addressable Audiences

Experian data integrated into FreeWheel's ecosystem enables UK advertisers to target addressable audiences across premium video inventory more precisely and at scale.

fromForbes

5 months agoCreators Just Became TV: How Samsung TV Plus & Tubi Are Selling Scale

For marketers, this is a window of opportunity. Even a creator with 20 million followers depends on algorithms to surface content. In CTV, the top creators appear in channels, a curated environment that looks and feels like television. That makes it easier for audiences to find them and brands to buy in. Creator shows are beginning to scale like TV programming with sponsorships, integrations, and media packages available, but now with loyal, intentional audiences built in.

Television

Marketing tech

fromExchangewire

5 months agoCTV Campaign Drives Strong Engagement for Thoughtworks, Delivering Significant Uplift in Clicks

Teads and Thoughtworks used CTV advertising with AI-driven contextual targeting and premium full-screen placements to reach 200,000+ users and boost B2B engagement.

[ Load more ]